Bitcoin Heavily Sold on Monday

BTC Under Pressure

Bitcoin bulls are on high alert this week as the futures market continue to reverse lower from last week’s highs. BTC is down almost 3% over early European trading on Monday and now down around 5% from last week’s highs. The move comes against the backdrop of a firmer US Dollar in the wake of the September FOMC. Despite the Fed cutting rates and signalling more to come, the upward revision to the bank’s GDP forecast and continued concern over inflation means that we haven’t seen the USD sell off many were expecting. For now, there is room for BTC to drift lower while USD remains bid.

US Data on Watch

Looking ahead this week, traders will be watching incoming US data closely. The bottom line is that any downside surprises will lead to stronger rate-cut expectations, weighing on USD and allowing BTC and risk assets to push higher. Any upside surprises, however, will dilute near-term easing expectations, leading USD higher and BTC and risk assets lower. US PMIs on Tuesday, jobless claims and GDP on Thursday and core PCE on Friday will be the key focus points this week.

Broader Crypto Sell-Off

The drop lower in BTC has seen an accompanying dip across the broader crypto space with industry data revealing around $1.7 billion in crypto long liquidation in the last 24-hrs. This includes around $1 billion in BTC liquidations alone and suggests the current correction lower could have furtehr to run. Despite the downturn, big names continue to buy with Japanese firm Metaplanet now the fifth largest global holder on the back of a further $632 purchase this week. Continue buying from big holders, despite the current drop in retail activity suggests that a fresh push higher before year end is still likely.

Technical Views

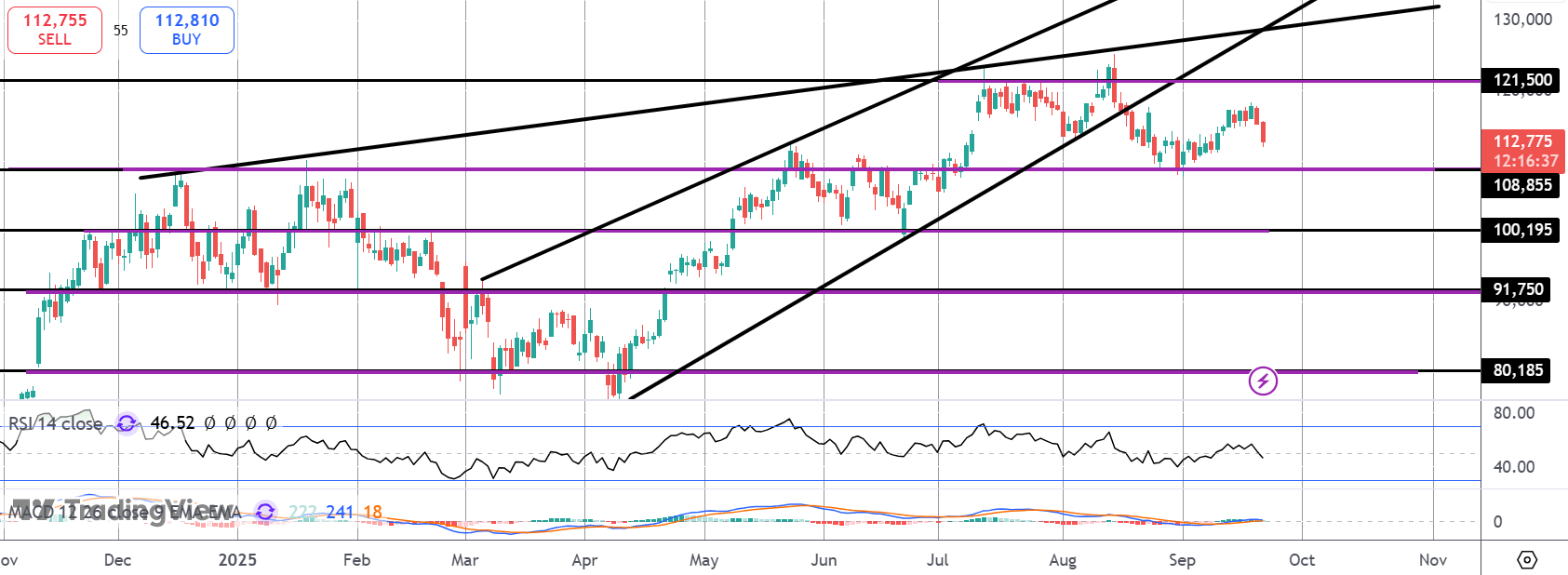

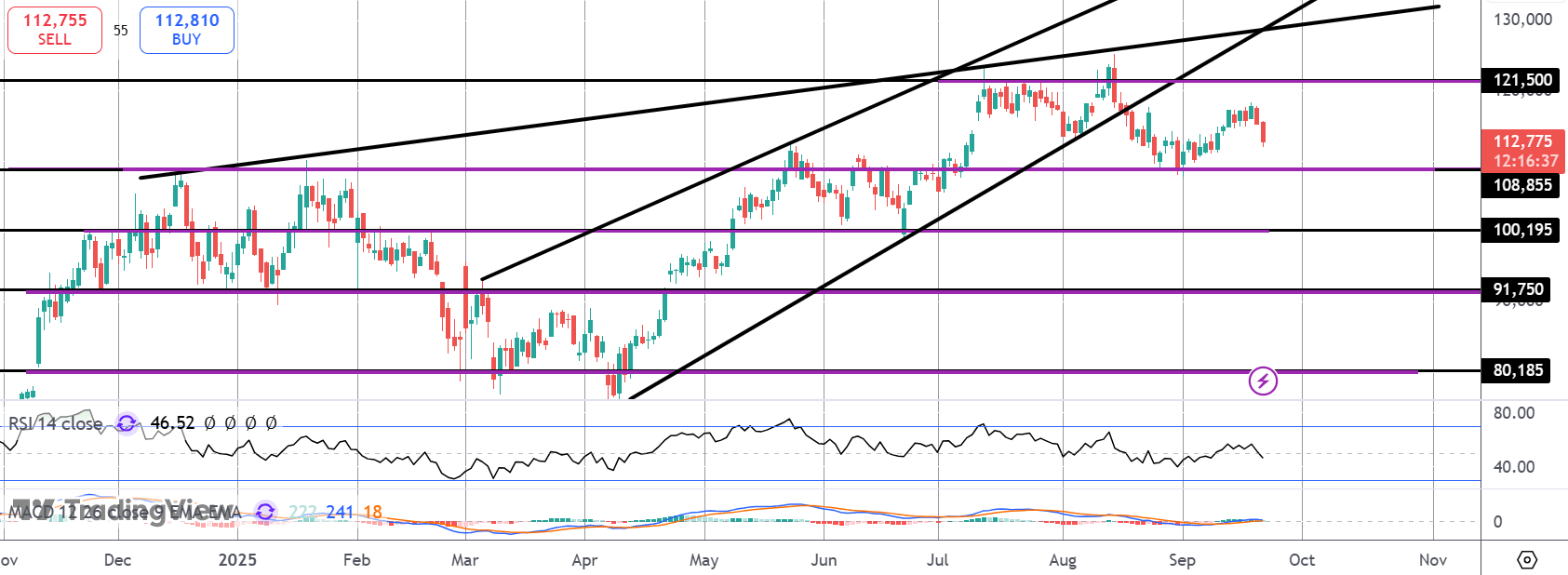

BTC

The market is turning lower once again and all eyes will be on the $108,855 level. This has been a key support level through the summer which bulls will need to defend to maintain the near-term upside bias. If broken, focus turns to deeper support at the $100k level next, in line with weakening momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.