Bitcoin Lacking Bullish Momentum

BTC Still Stuck

It’s been a tricky week for Bitcoin bulls. Following a heavy sell off on Monday, price had staged a recovery through the middle of the week before turning lower again today. Resilience in the US has been partially attributed to the failed recovery with the Dollar grinding higher through the week, supported by comments from Fed chair Powell earlier in the week. Speaking in the wake of the September FOMC, Powell reiterated concerns over upside inflation risks and the fine balance between them and downside labour market risks. The market is still pricing in a further .25% cut in October with around a 70% chance of an additional cut by year end. However, USD has failed to sell off, suggesting that it will take some fresh downside data surprises to drive fresh selling.

ETF Inflows

Despite the recent stagnation in BTC, ETFs have continued to see strong inflows with funds recording just shy of $2 billion in inflows last week. Additionally, Michael Saylor, head of Strategy (largest global holder of BTC) noted his view this week that BTC is primed for a strong rally through year end as a result of increased mainstream uptake, better regulatory support and institutional buying. As such, the current lull in BTC could offer a good opportunity for bulls looking to position for a Q4 rally, in line with the average returns of more than 80% delivered in Q4 over the last decade.

Technical Views

BTC

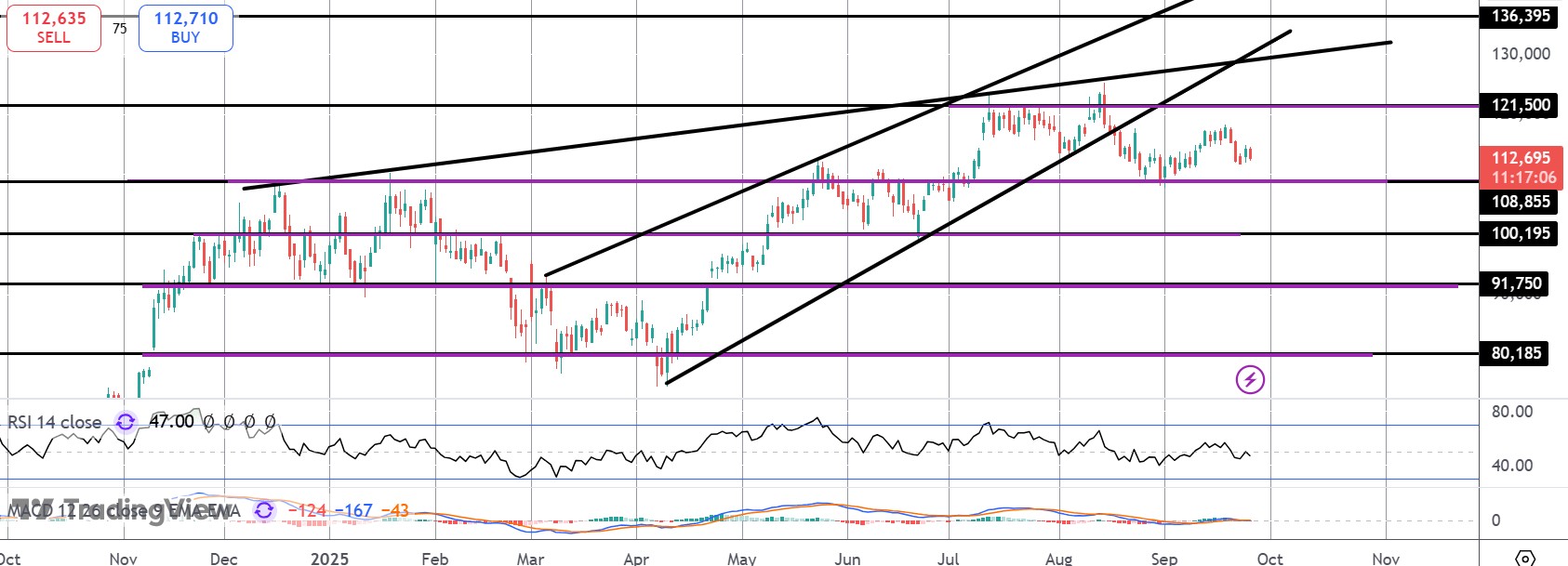

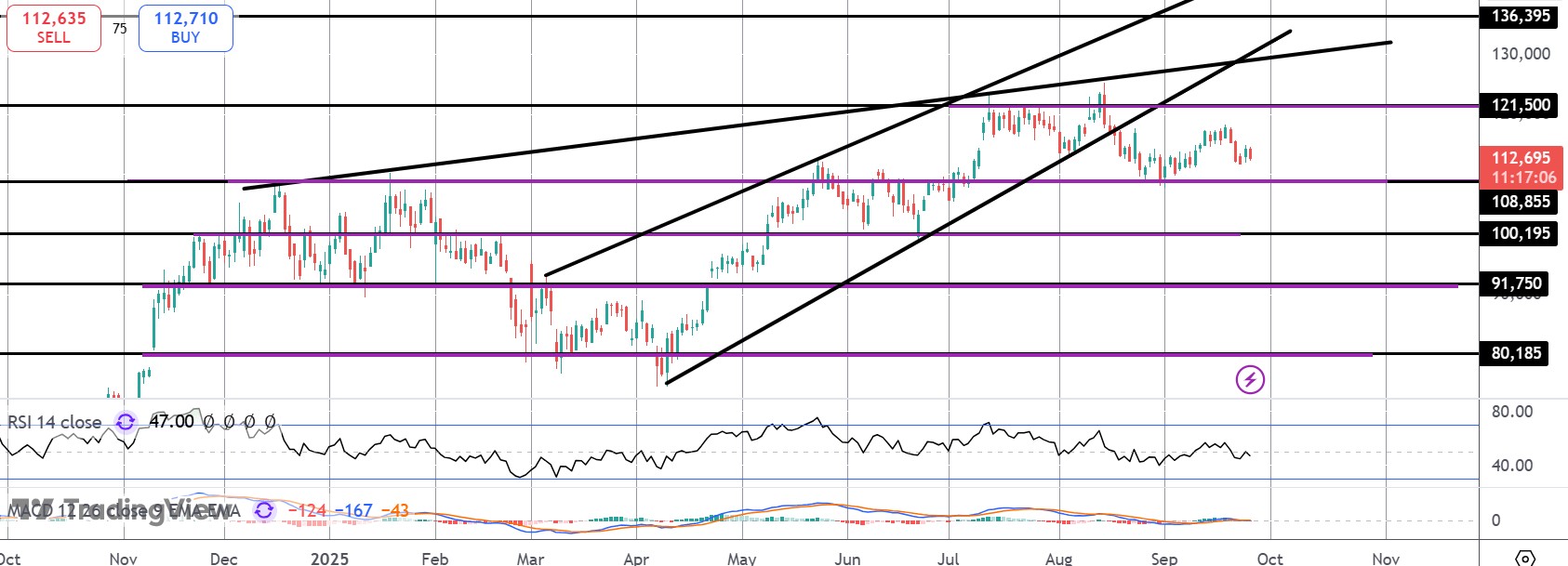

For now, BTC remains rangebound between support at the $108,855 level and resistance at $121,500. Momentum studies are weak suggesting risks of a break lower. If we do push down here, the $100k mark will be the key level to watch with bulls needing to defend that region to keep broader focus on a test of $136,395 in coming weeks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.