Crude Rallies Despite EIA Oversupply Concerns

Crude Recovery Continues

Crude prices continue to push higher mid-week as the recovery rally grinds on. The recent decision from OPEC+ to hike output next month by 137k barrels per day, in line with October’s increase, has helped bolster sentiment. OPEC+ has scaled back production hikes in recent months, reflecting a desire to balance growth with price support. These more modest increases are clearly being welcomed by bulls with crude now on course for its fourth day in the green.

EIA Hikes Output Forecasts

Concerns around supply levels remain a key issue for crude traders. The EIA this week hiked its crude output forecasts for the remainder of the year. The group forecasts that prices will fall from the current average of $69/pb to around $52/pb next year. Global stocks are expected to rise through Q4 2025 and continue higher into next year, putting pressure on prices.

EIA Inventories Up Next

Looking ahead today, traders will be watching the latest EIA inventories update. The market is looking for a mild surplus of 0.4 million barrels which, if seen, will likely have little impact. Given the bullish sentiment in the market currently, only a firm upside surprise today will likely weigh on crude. Indeed, the rally in crude this week is seen despite the ongoing rise in USD. A sharp drop in EUR and JPY linked to political developments in France and Japan has fuelled a spike in USD this week with traders overlooking the ongoing US government shutdown. On the other hand, a downside surprise in today’s data should feed into a furtehr rally for crude near-term.

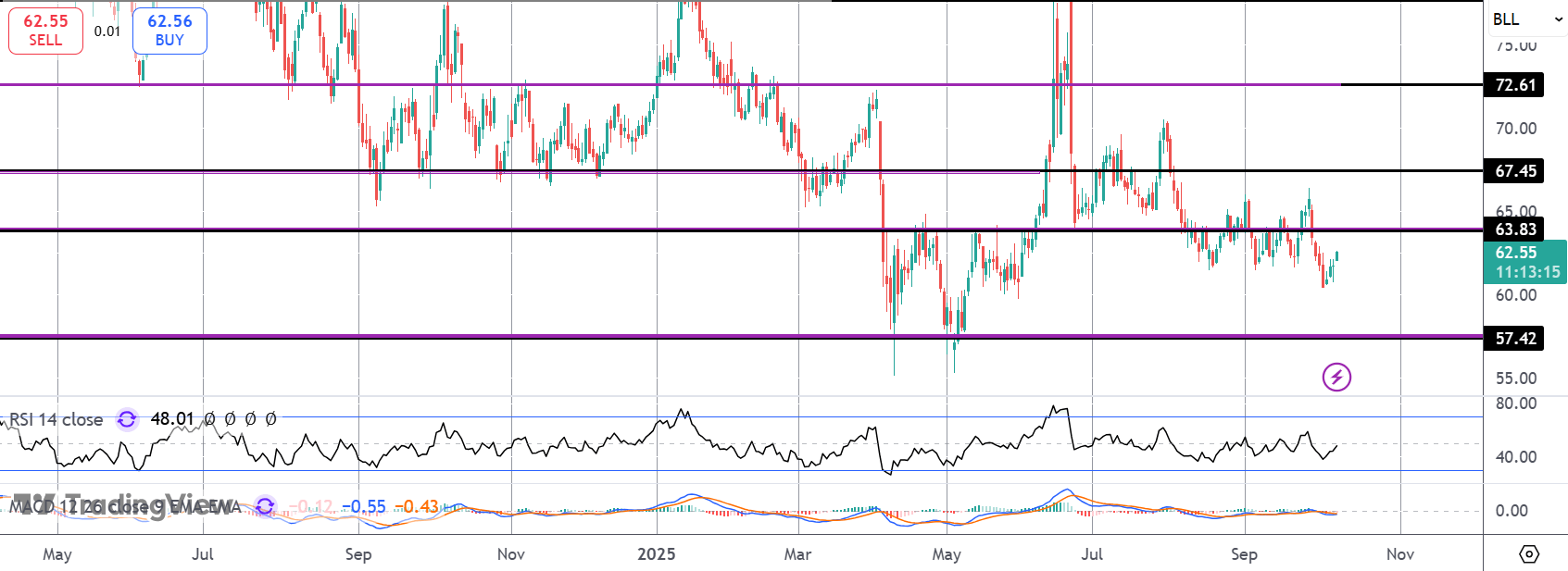

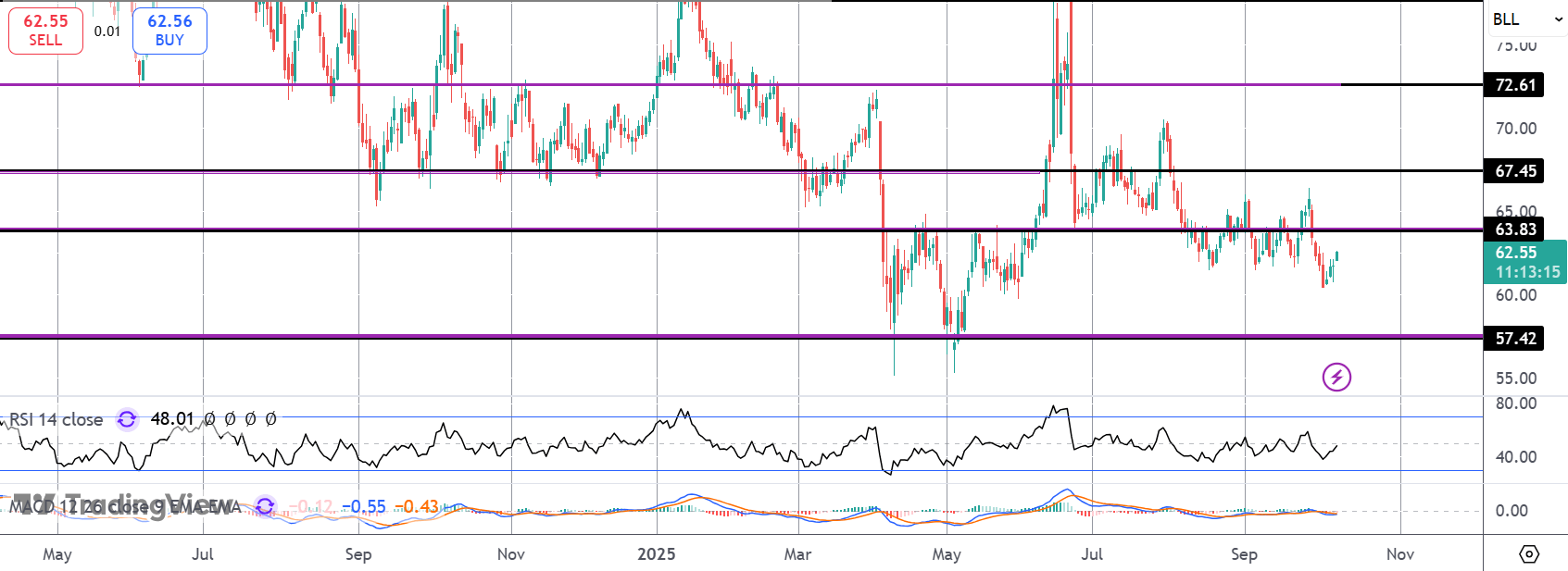

Technical Views

Crude

Crude prices are bouncing back towards a test of the 63.83 level which will be the deciding level for the rally. A break higher will encourage fresh momentum towards the 67.45 level next. However, failure here sees the risk of a fresh drop towards 57.42 and the YTD lows, in line with weak momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.