Daily Market Outlook, August 16, 2024

Daily Market Outlook, August 16, 2024

Munnelly’s Macro Minute…

“UK consumers gradually return to the high street in July”

Asian stock markets are trading mostly higher on Friday, buoyed by the positive sentiment from Wall Street's overnight performance. Stronger-than-expected US retail sales and weekly jobless claims data have helped alleviate concerns about a recession in the world's largest economy. However, this positive data is likely to prompt the US Federal Reserve to implement a smaller interest rate cut in September. The Japanese stock market is trading significantly higher on Friday, building on the gains from the previous four sessions. The benchmark Nikkei 225 is soaring, rising above the 38K handle, with gains seen across all sectors, led by index heavyweights and financial and technology stocks.

The UK consumer returned to the high street in July thanks to a brief break from what felt like constant rain; sales increased by +0.5% m/m (median +0.6%) from an upwardly revised -0.8% m/m in June (from -1.2%). Eliminating fuel causes the statistics to increase to +0.7% m/m from the previous revision of -1.3% (up from -1.5%). Sales excluding gasoline are therefore +1.4% year over year. Sales at department stores had the biggest increase, rising by +4.0% m/m, while sales at other non-food stores increased by 2.5% m/m. Sales of food remained unchanged, but those of apparel and home items were down by -0.6% month over month, and sales of gasoline for automobiles decreased by 1.9% as compared to June. As a result, there are still areas of weakness, and it will be some time before we can talk about consumer strength. In fact, overall sales volumes remain lower than they were at the beginning of 2019 (-0.8%), and the fall appears even more pronounced (-4.3%) when looking at sales volumes per capita. Retailers appear to anticipate these conditions to persist, based on survey data. The main reason for the BoE's ongoing inflation issue is that consumer preferences, services activity, and confidence have all increased. In actuality, that comes first when it comes to retail sales numbers (barring obvious weakness).

Stateside the key data release for the day will be University of Michigan U.S. consumer sentiment preliminary reading (August) - 55.1. Rounding out the week out will be Fed's Goolsbee who speaks later

Overnight Newswire Updates of Note

RBNZ Rate-Cut Path Could Change On Price, Wage Setting

RBA’s Michele Bullock: Premature’ To Think About Rate Cuts

Fed Chair Powell To Headline Next Week's Jackson Hole Meet

UK Government Woos Revolut For Potential IPO

Donald Trump’s Economic Plans Would Hurt US Business

Walz And Vance Agree To October US VP Debate

Carry Trade That Blew Up Markets Attracts Hedge Funds Again

Aussie Holds Higher Ground Above 0.6600, Hawkish RBA

Kiwi Trades With Mild Losses On Dovish RBNZ

Loonie Gives Back Some Recent Gains After Weak CAD Data

Gold ETF Inflows Reach 2-Year High, Possible US Rate Cut

Oil Rises 2% On Upbeat US Data, Geopolitical Tension

US EIA: China's Diesel Demand Fell In June

Asian Stocks Rally As Fears Of US Recession Recede

Google’s Antitrust Defeat Could Shape AI Markets

Nvidia Vs Startups: AI Chip Challengers Chase Efficiency

Citadel, DE Shaw Slashed Nvidia Holdings Ahead Of MKT Rout

Softbank, SK, LG, And Hanwha To Join Asia-focused AI Fund

Stellantis Shareholders Sue Automaker Over Misinformation

Fmr Israeli-US Ambassador Questions Hamas Deal Readiness

Ukraine’s Incursion Disrupts Putin’s War Conquest

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900-10 (1.5BLN), 1.0950-60 (2.5BLN), 1.1000 (2.7BLN)

1.1025 (1.1BLN), 1.1040-50 (788M)

USD/CHF: 0.8700 (758M), 0.8720 (677M)

EUR/GBP: 0.8600 (590M)

GBP/USD: 1.2785 (414M), 1.2820-25 (311M), 1.2880 (562M)

AUD/USD: 0.6520 (919M), 0.6550-60 (1BLN), 0.6600 (921M)

USD/CAD: 1.3670-75 (1BLN), 1.3700 (1BLN), 1.3790-95 (944M)

USDJPY: 148.00 (658M), 150.00 (454M)

Early in August, carry trades were unwound due to risk aversion brought on by fears of a U.S. recession. As a result, the implied volatility of FX options increased significantly. The revelation of robust retail sales and in-line CPI statistics for the United States, however, allayed these anxieties and revived anticipation of a soft U.S. landing, allowing risk assets to recover. Since then, the implied volatility of FX options has dropped back to previous lows. Prior to the September nonfarm payrolls and Fed meeting, there will not be much noteworthy U.S. data, so this should control FX volatility, support risk assets, and maintain pressure on option premiums.

CFTC Data As Of 09/8/24

Equity fund speculators trim S&P 500 CME net short position by 25,312 contracts to 222,856

Equity fund managers cut S&P 500 CME net long position by 57,309 contracts to 881,533

Swiss franc posts net short position of -22,073 contracts

British pound net long position is 74,399 contracts

Euro net long position is 33,580 contracts

Japanese yen net short position is -11,354 contracts

Bitcoin net long position is 538 contracts

Technical & Trade Views

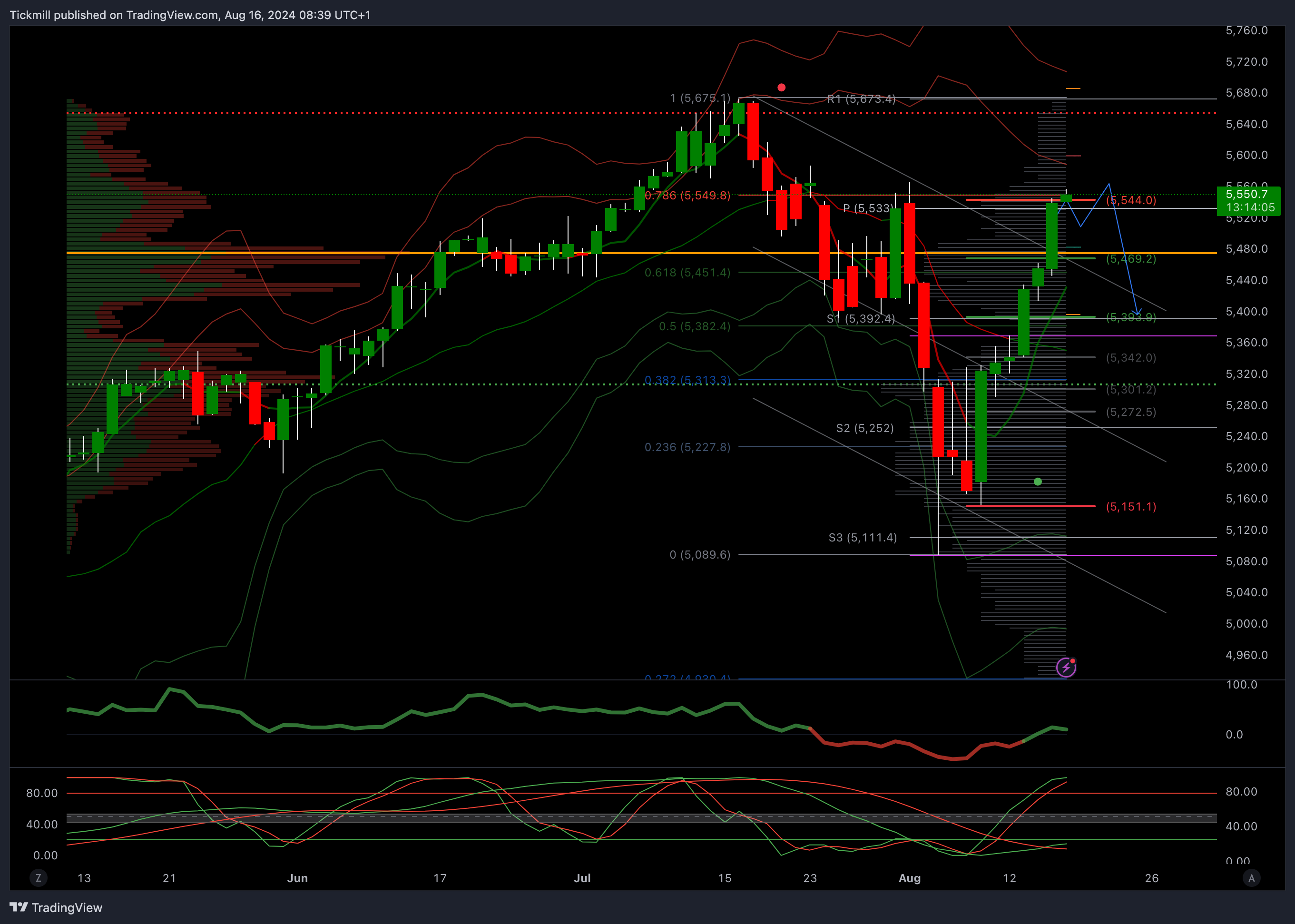

SP500 Bullish Above Bearish Below 5475

Daily VWAP bullish

Weekly VWAP bullish

Above 5470 opens 5670

Primary resistance 5670

Primary objective is 5000

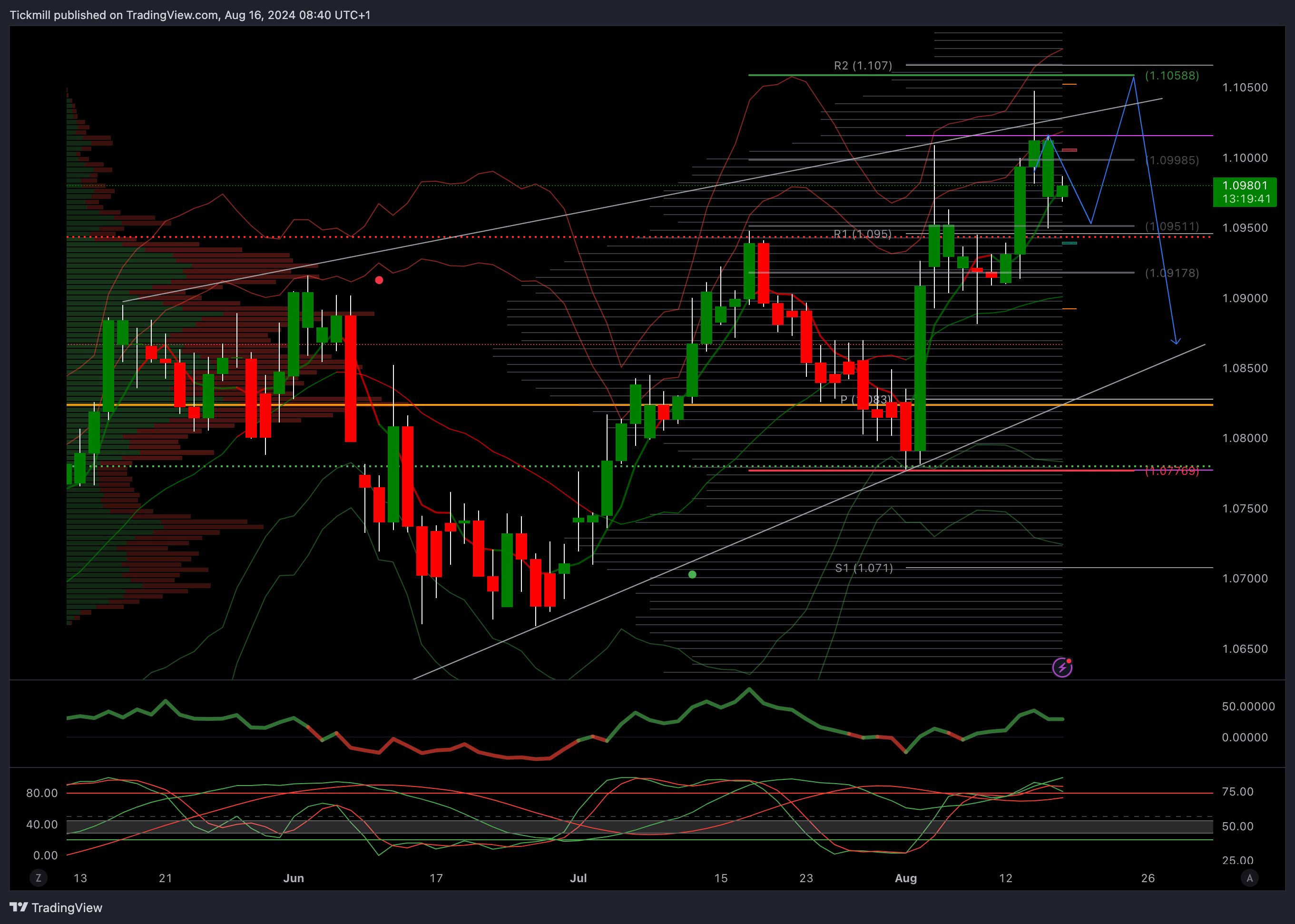

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.0975 opens 1.1058

Primary resistance 1.0981

Primary objective is 1.07

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bullish

Weekly VWAP bearish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.2450

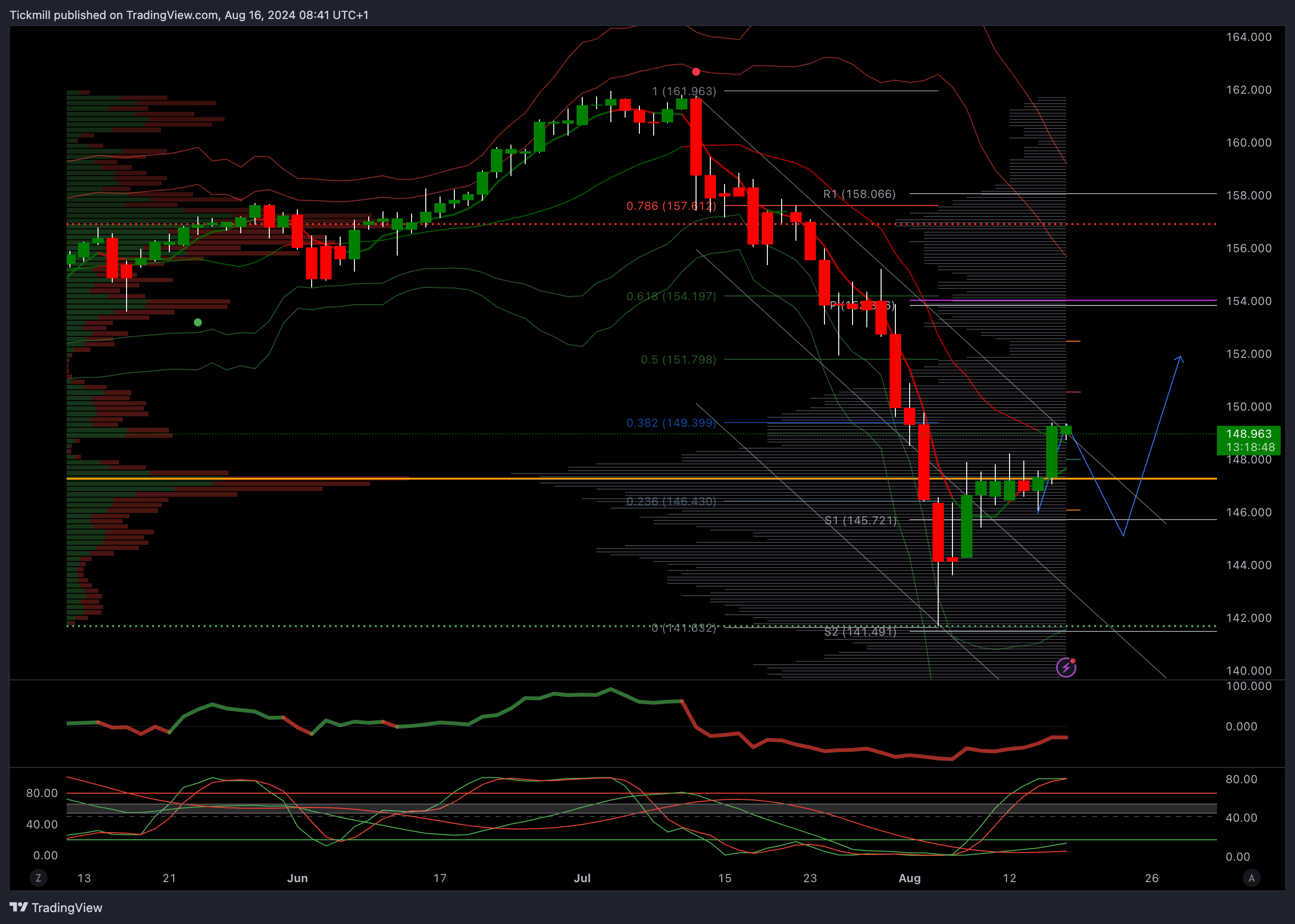

USDJPY Bullish Above Bearish Below 149

Daily VWAP bullish

Weekly VWAP bearish

Above 150 opens 153

Primary support 140

Primary objective is 153

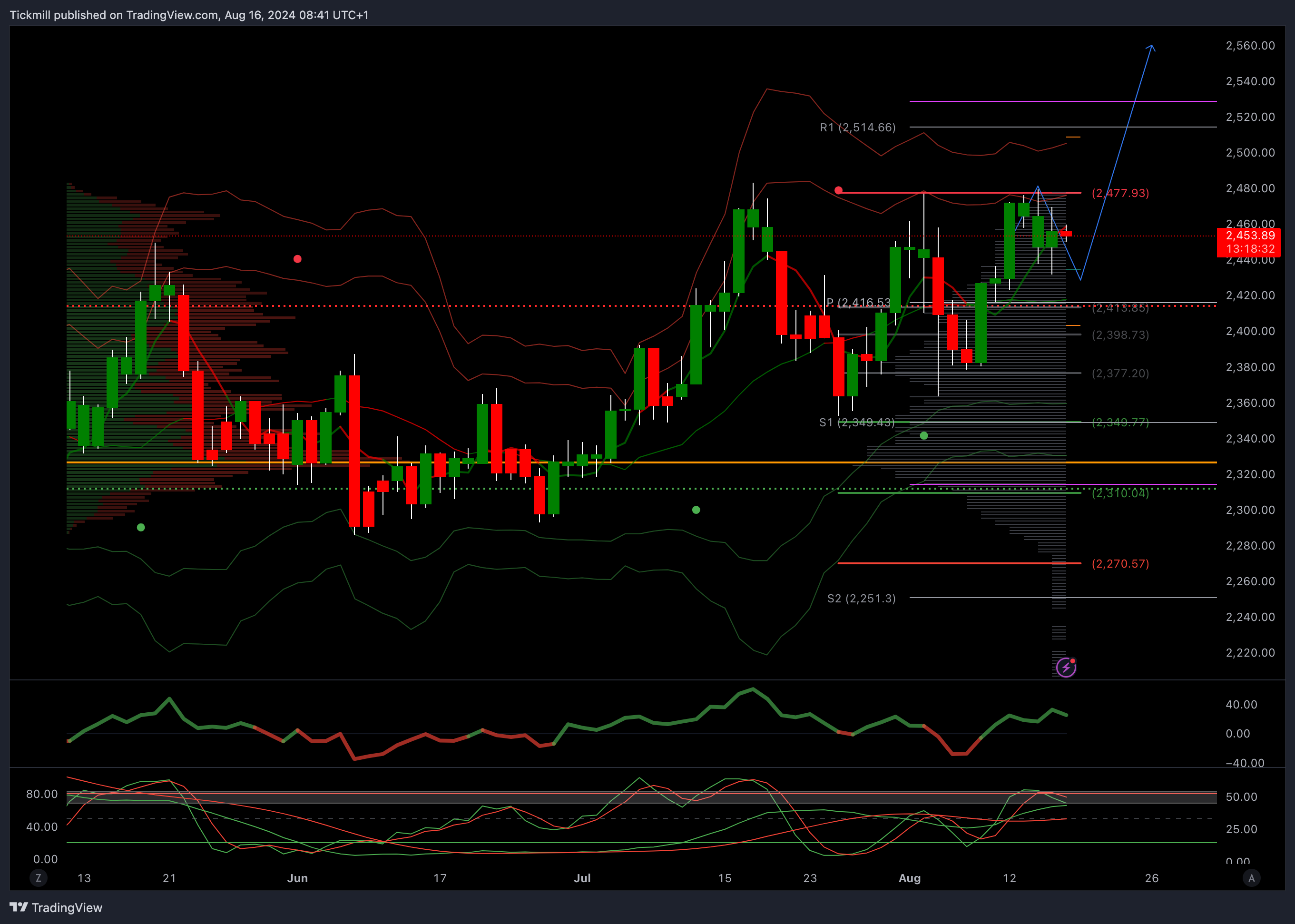

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

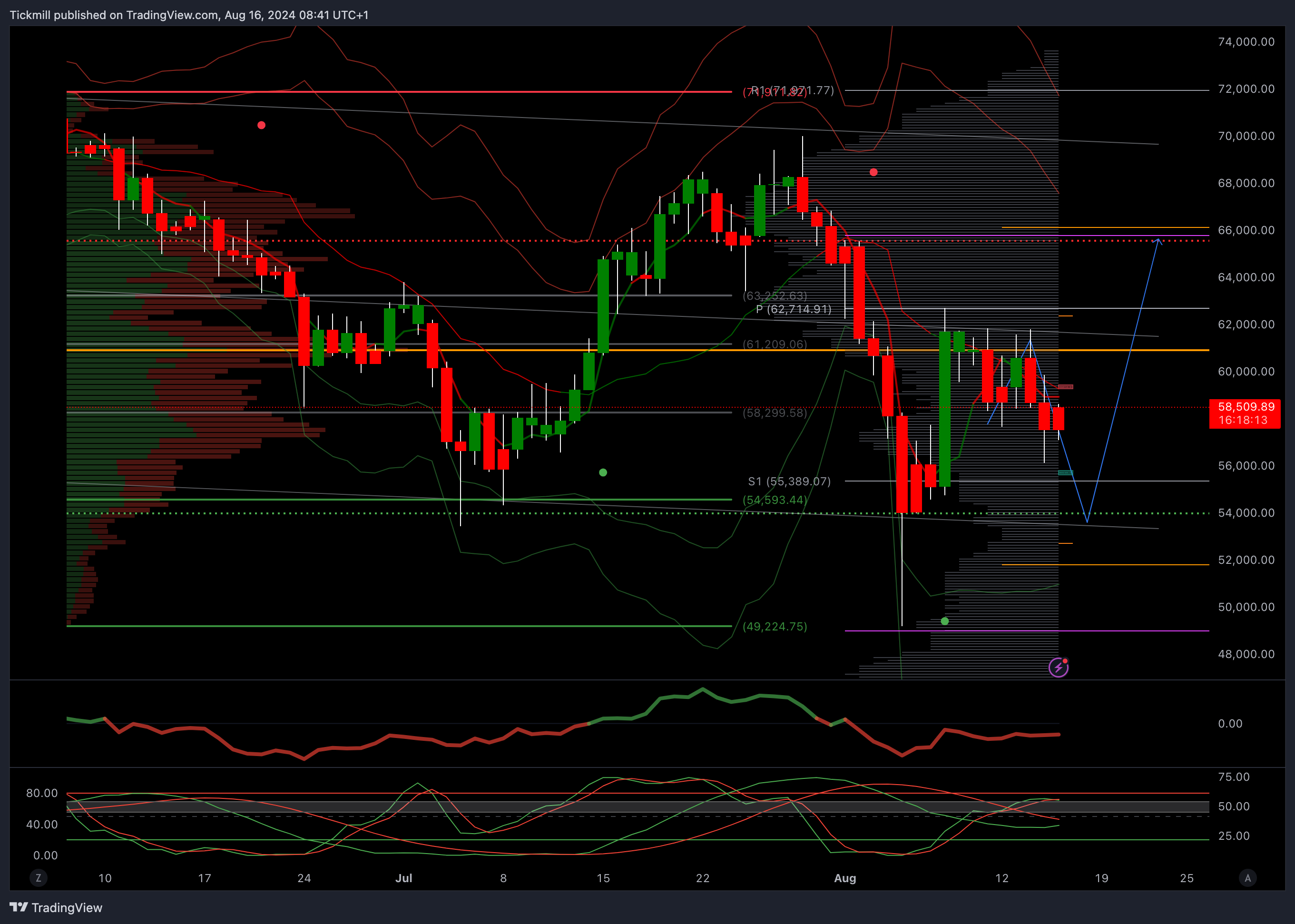

BTCUSD Bullish Above Bearish Below 58000

Daily VWAP bearish

Weekly VWAP bearish

Above 61000 opens 68000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!