Daily Market Outlook, June 7, 2024

Daily Market Outlook, June 7, 2024

Munnelly’s Macro Minute…

“US Jobs Data To Wrap The Week”

Equity performance across the Asian region is mixed ahead of today’s US nonfarm payrolls report, though most markets are on track to end the week positively. Recent trade data from China revealed a larger-than-expected trade surplus in May, driven by a stronger-than-anticipated increase in exports and a slower rate of import growth. This outcome bolsters hopes that China can sustain its growth momentum.

At its meeting yesterday, the European Central Bank (ECB) decided to cut interest rates by 25bps, bringing the deposit facility rate down to 3.75%. Additionally, the ECB reduced the main refinancing rate and the marginal lending rate by 25bp each, to 4.25% and 4.50% respectively. This marks the first rate reduction since 2019, following nine months of steady rates. The decision was widely anticipated, as policymakers had signaled the move in advance. The ECB is now the second G7 central bank to reduce rates, following the Bank of Canada's decision. Meanwhile, the Bank of England and the US Federal Reserve have not yet started cutting rates, and the Bank of Japan has raised rates this year.The ECB provided no definitive signals about future policy changes, maintaining a data-dependent stance and noting that “the Governing Council is not pre-committing to a particular rate path.” This suggests that another rate cut next month is unlikely, especially after recent data indicated persistent wage growth and high services price inflation in the Eurozone. Markets now expect the next rate cut to occur in either September or October. Today, several ECB officials, including Nagel, Simkus, Holzmann, Schnabel, Centeno, and President Lagarde, are scheduled to speak, which will attract market attention as participants try to gauge future policy directions.

The focus today is on the US monthly labour market report for May. The April report showed signs of a slowdown in the jobs market, with the economy adding only 175,000 jobs, an increase in the unemployment rate to 3.9%, and a moderation in average hourly earnings growth to 3.9% year-on-year. For May, expect an increase in nonfarm payrolls to 225,000, with the unemployment rate and annual wage growth remaining steady at 3.9%. Unless there is a significant surprise, the US data is likely to support the Fed's current stance of maintaining interest rates at their current levels for a while longer.

In other economic news, the final Eurozone Q1 GDP print is expected to confirm growth of 0.3% quarter-on-quarter. Additionally, the Canadian labour market report for May is forecast to show a further increase in the unemployment rate.

Overnight Newswire Updates of Note

JPMorgan, Citi Cling To July Fed Rate-Cut Bets Ahead Of Jobs Data

ECB Officials All But Rule Out July Cut With September Unclear

Some ECB Hawks Regret Premature Cut Commitment, Sources Say

Ukraine Ready For EU Membership Talks, Brussels Says

China Exports Surge In May, Trade Balance Grows While Imports Shrink

Japan’s Suzuki Says To Consider The Effectiveness Of Intervention

Japan FinMin Jawboning Pre-US Jobs Report, Warning To Specs

Japan’s Households Boost Outlays First Time In 14 Months

A Majority Of BoJ Watchers Expects Cut In Bond Buying Next Week

Moody’s May Cut Six US Banks On Commercial Real Estate Exposure

Japan's MUFG, SMFG To Sell More Than $8.5 Billion Of Toyota Shares

Mexican Peso Tumbles As Ruling Party Vows To Pass Reform

Netanyahu Invited To Address Both Houses Of Congress On July 24

Qatar ForMin: Hamas Has Not Responded To Latest Ceasefire Proposal

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0795-1.0800 (897M), 1.0850 (532M), 1.0875-85 (3.3BLN)

1.0895-1.0900 (2.3BLN), 1.0920-30 (716M), 1.0940-50 (1.1BLN)

USD/CHF: 0.8900 (520M),0.8915 (300M), 0.8925 (1.2BLN), 0.9000 (846M)

EUR/CHF: 0.9700-10 (450M), 0.9850 (526M)

EUR/GBP: 0.8500 (200M), 0.8530 (257M)

GBP/USD: 1.2695 (315M), 1.2800 (645M)

AUD/USD: 0.6600 (1.2BLN). NZD/USD: 0.6100-15 (1.3BLN)

USD/CAD: 1.3675-80 (1.2BLN), 1.3720-30 (1.1BLN), 1.3745-50 (675M)

1.3800 (2.8BLN)

USD/JPY: 154.50 (1.1BLN), 155.00 (487M), 156.00-05 (560M), 156.25 (350M)

156.50 (860M), 157.00 (1.3BLN), 157.25 (500M)

EUR/JPY: 167.50 (800M). EUR/NOK: 11.45 (230M)

CFTC Data As Of 31/05/24

Japanese yen net short position is -156,039 contracts

Euro net long position is 57,572 contracts

Swiss franc posts net short position of 44,366 contracts

British pound net long position is 25,402 contracts

Bitcoin net short position is -756 contracts

Equity fund managers raise S&P 500 CME net long position by 31.431 contracts to 978,007

Equity fund speculators increase S&P 500 CME net short position by 12,145 contracts to 330,057

Gold NC Net Positions increased to $236.6K from previous $229.8K

Technical & Trade Views

SP500 Bullish Above Bearish Below 5330

Daily VWAP bullish

Weekly VWAP bullish

Below 5330 opens 5300

Primary support 5275

Primary objective is 5392

EURUSD Bullish Above Bearish Below 1.0860

Daily VWAP bullish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.0550

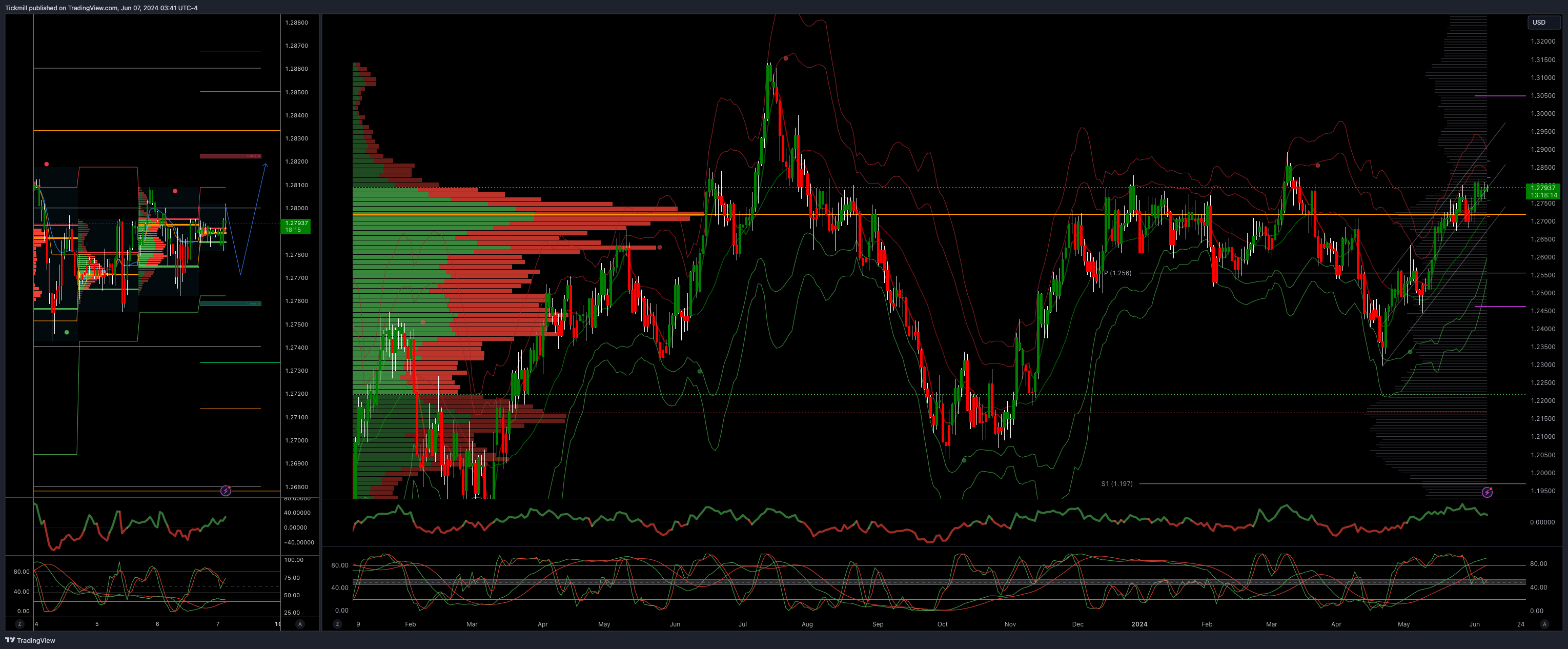

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bullish

Weekly VWAP bullish

Below 1.2740 opens 1.2690

Primary support is 1.2670

Primary objective 1.2850

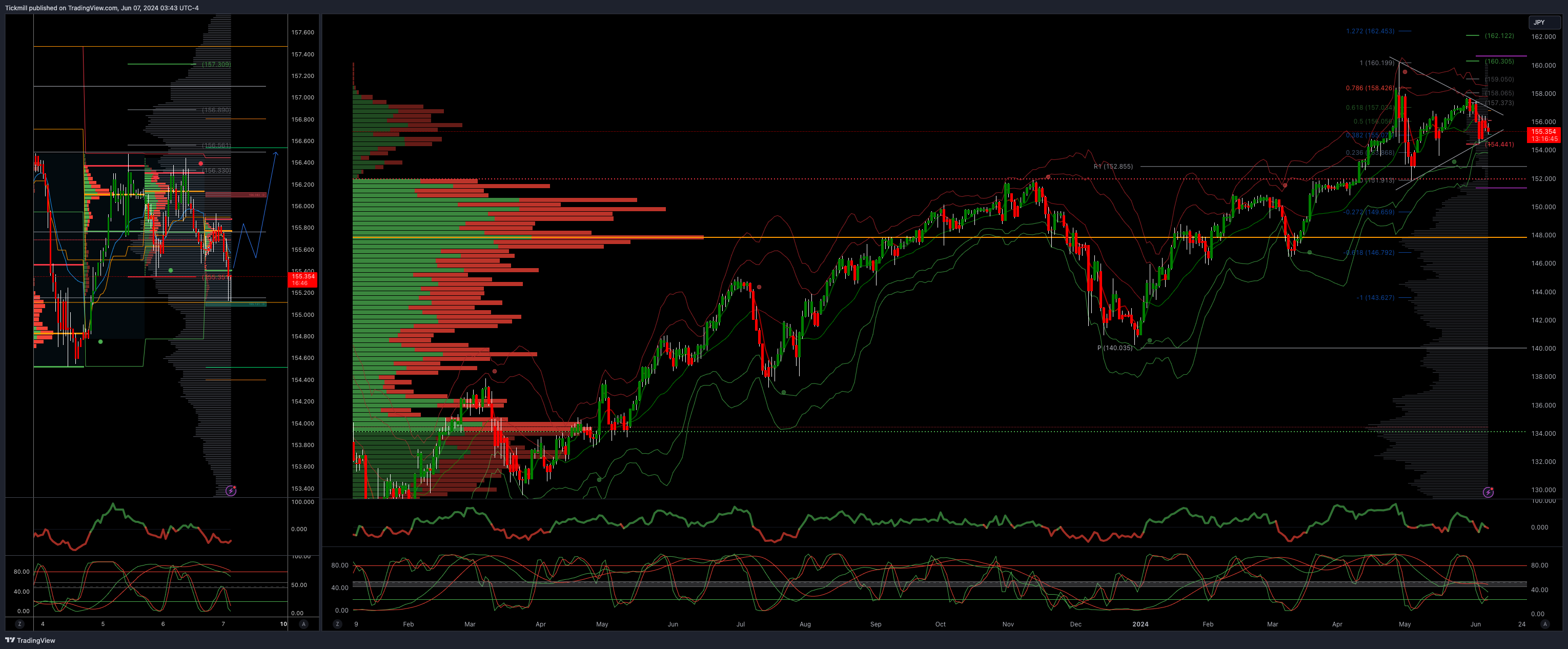

USDJPY Bullish Above Bearish Below 155.30

Daily VWAP bearish

Weekly VWAP bullish

Below 155.30 opens 154.50

Primary support 152

Primary objective is 160

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bullish

Weekly VWAP bearish

Above 2365 opens 2390

Primary support 2300

Primary objective is 2239 Below 2300

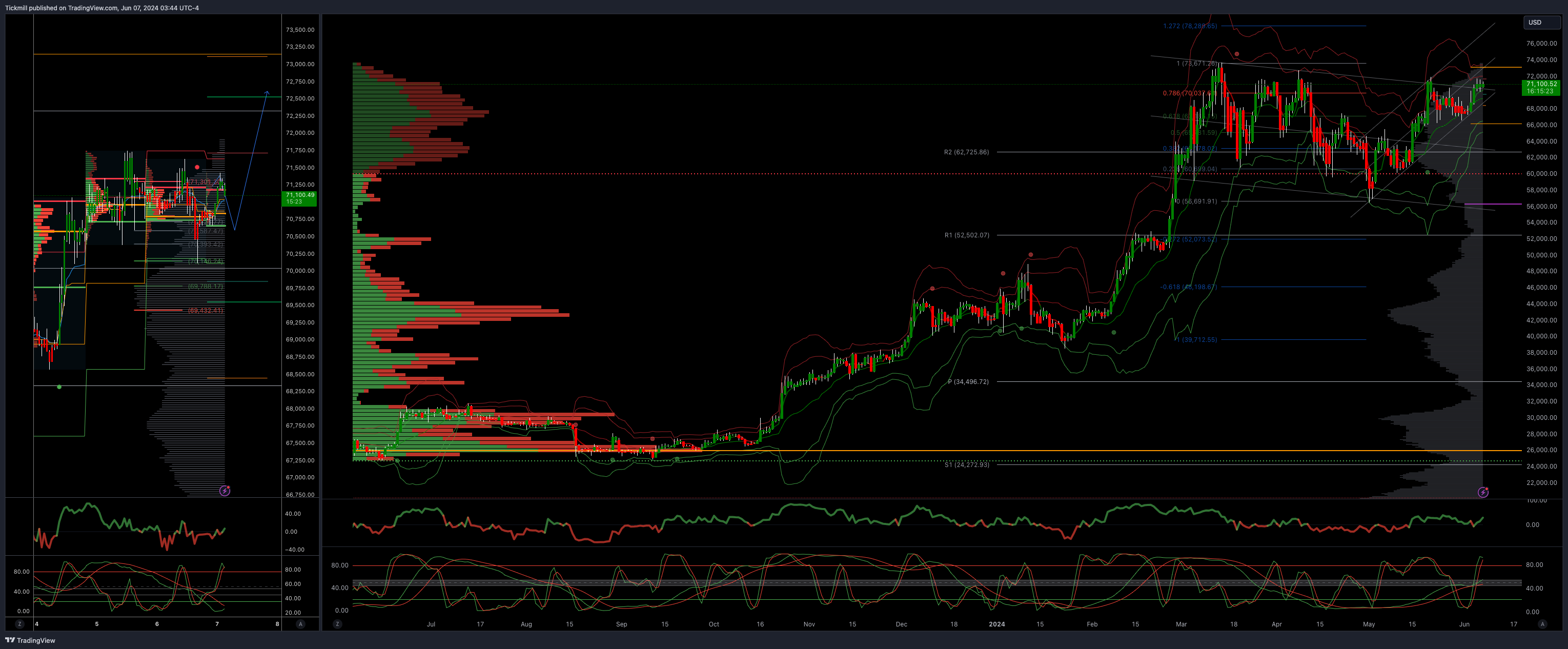

BTCUSD Bullish Above Bearish below 70000

Daily VWAP bullish

Weekly VWAP bullish

Below 69400 opens 68400

Primary support is 65000

Primary objective is 78200

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!