Institutional Insights: Citadel 'Tactical Update Into Year End'

Summary of Scott Rubner’s year-end market note

Subject: Year-End Tactical Update – The Market Has "Healed"

Outlook: Constructive / Bullish into Year-End & 2026

---

## 🧭 Executive Summary: The "Pain Trade" is Higher

The technical dislocations that dominated November have resolved. The U.S. equity market has "meaningfully healed," transitioning from mechanical selling pressure back to fundamental drivers.

With 18 trading days left in 2025, the setup is decisively favorable for the buy-side. The combination of seasonal tailwinds, corporate buybacks, and systematic re-leveraging suggests that FOMO (Fear Of Missing Out) will drive prices higher.

The Big Picture: We are entering 2026 with a potent mix of fiscal, technological, and political catalysts.

---

## 🏗️ The Macro Framework: "The Three P’s"

Rubner anchors his bullish view on three structural pillars for 2026:

| Pillar | Key Drivers |

| :--- | :--- |

| 1. PROFITS | • AI Diffusion: Growth is broadening beyond mega-cap tech; AI adoption is boosting productivity across the S&P 500.<br>• CapEx Supercycle: $700B+ in annual tech investment.<br>• Earnings: S&P 500 delivering strong 13% YoY growth. |

| 2. POLICY | • Fiscal Impulse: U.S. running >$2T annual deficits + global stimulus (Germany/Japan).<br>• Fed Pivot: QT ended Dec 1st; balance sheet expansion likely in 2026.<br>• Deregulation: Easing constraints adds tailwinds across sectors. |

| 3. POSITIONING | • Light Positioning: Investors are under-allocated; FOMO is pulling capital back in.<br>• Retail Engagement: Retail remains the primary price setter and is fully engaged.<br>• Systematic Bid: Volatility control funds are mechanically forced to buy. |

---

## ✅ The GMI Market Technicals Checklist (10 Signals)

November’s technical damage has been repaired. Here is the evidence:

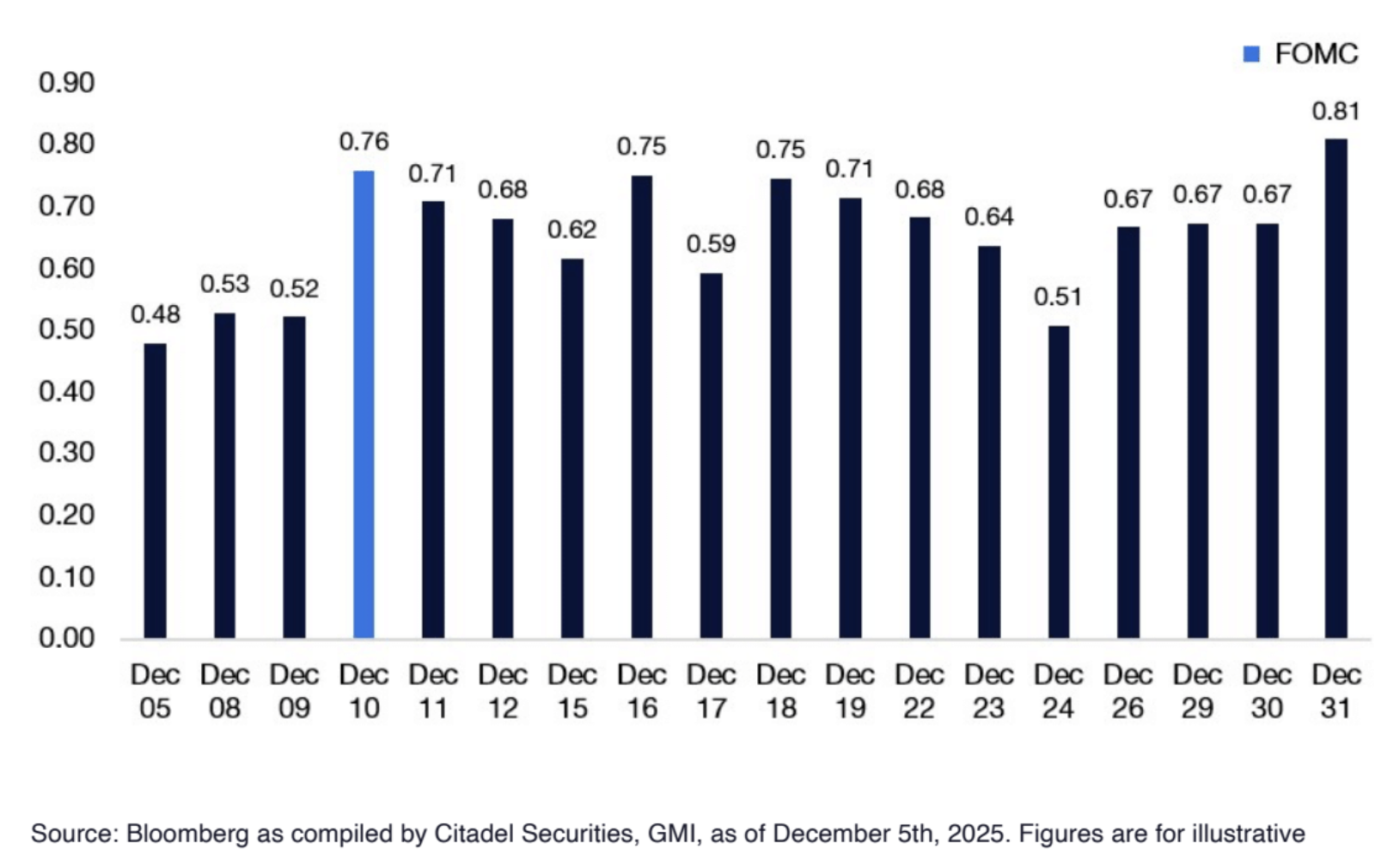

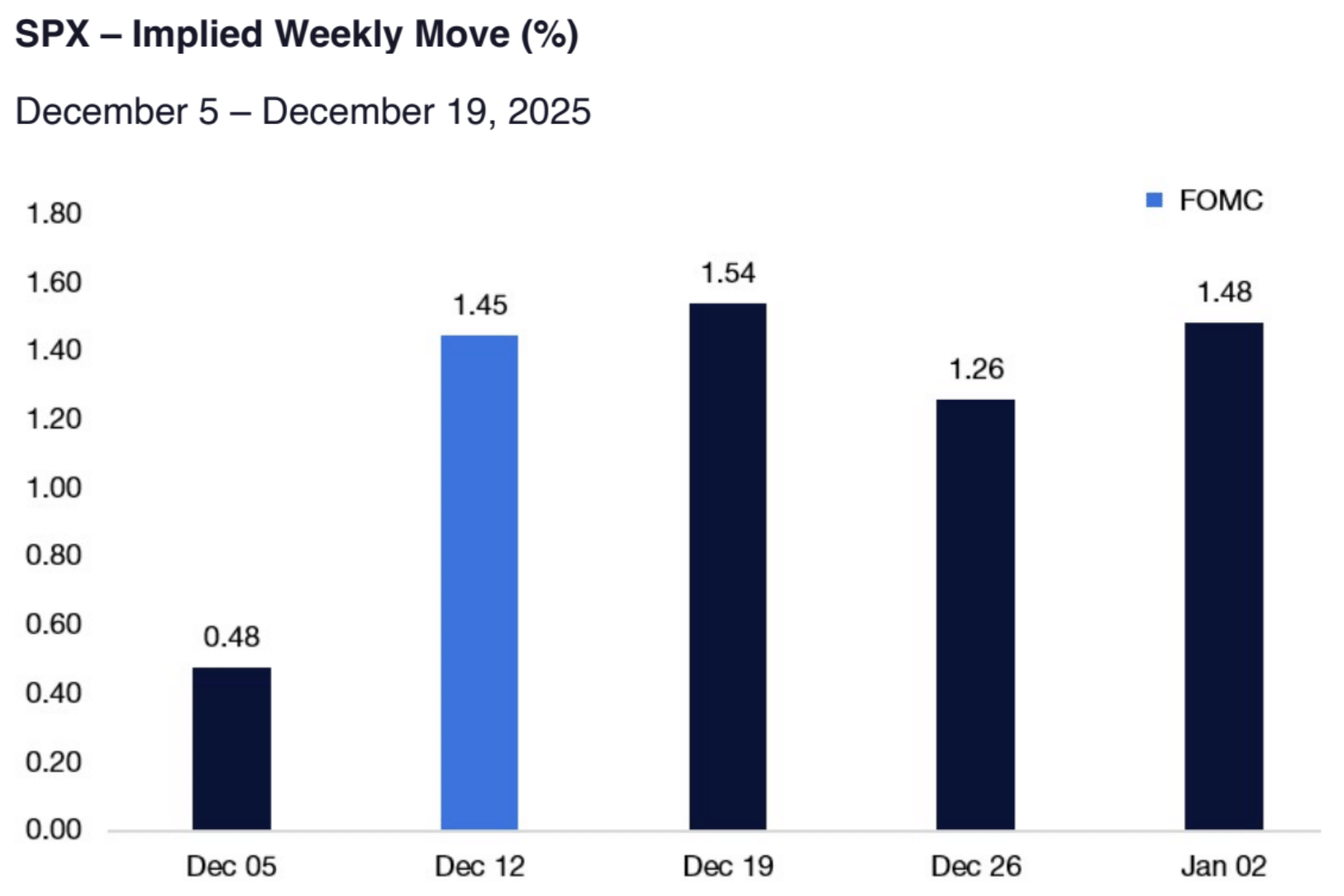

1. Intraday Volatility is Moderating: The violent intraday swings seen post-NVDA earnings have stabilized.

2. Systematic Re-leveraging Has Begun: Implied volatility is compressing. As realized vol drops, mechanical strategies (CTAs, Risk Parity) are forced to add exposure.

3. Skew is Flattening: Downside panic has evaporated. The cost of protective puts (skew) has normalized from April-2025 highs.

4. Put Volumes Normalized: Put buying has dropped back to the 40th percentile, signaling a reduction in fear.

5. ETF Panic Subsiding: ETF volume share spiked to 41% in Nov (panic hedging) but has reverted to the 28% average. This signals a return to single-stock picking.

6. Liquidity Returning: Top-of-book depth in E-mini futures (ES1) has bounced back from lows, improving execution quality.

7. Correlations Breaking Lower: Correlations have dropped to the 50th percentile. Translation: This is a stock-picker’s market again, allowing for idiosyncratic alpha.

8. CTAs are Buying: Futures are trading above key trigger levels. The mechanical de-risking is over; the buying has started.

9. The "Santa Claus" Seasonality: We are entering the best 2-week trading window of the year. Historically, the second half of December sees the SPX trade higher 75% of the time.

10. The Buyback Bid: The corporate window is open. Rubner projects $5.3 Billion in daily VWAP demand from corporate buybacks through year-end ($1.3T total authorizations for the year).

---

## 🌊 Flow Dynamics & Sector Rotation

### Institutional vs. Retail

* Retail: After 30 consecutive weeks of net buying (a record), retail paused last week to lock in gains. However, they remain thematically engaged in "Fed cut" plays.

* Institutions: Aggressively buying. Net better buyers by 9% this week, chasing performance into the close.

### Broadening Breadth

The rally is no longer just about the "Magnificent 7."

* Rotation: Small Caps (RTY), Regional Financials, and Homebuilders are surging.

* Catalyst: A repricing of the Fed. Markets now price a 91% probability of a December rate cut (up from 29% two weeks ago).

* Tech Debate: A fundamental shift is occurring within tech—investors are debating TPU vs. GPU leadership, reassessing who has the durable AI advantage.

---

## 💡 The Bottom Line

The market is out of sellers. The "AI Bubble" narrative has peaked and faded.

* Technical Status: Healed.

* Fed: Dovish (Cut expected).

* Seasonality: Best of the year.

Rubner’s Conclusion:

> "Tech, momentum, and Bitcoin have stabilized. Breadth is improving. The Fed is leaning dovish... The path forward will not be linear, but the tape is clearly stabilizing. We remain constructive on the macro backdrop into year-end and early 2026."

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!