Institutional Insights: Goldman Sachs - Gold What's Going On Under The Hood

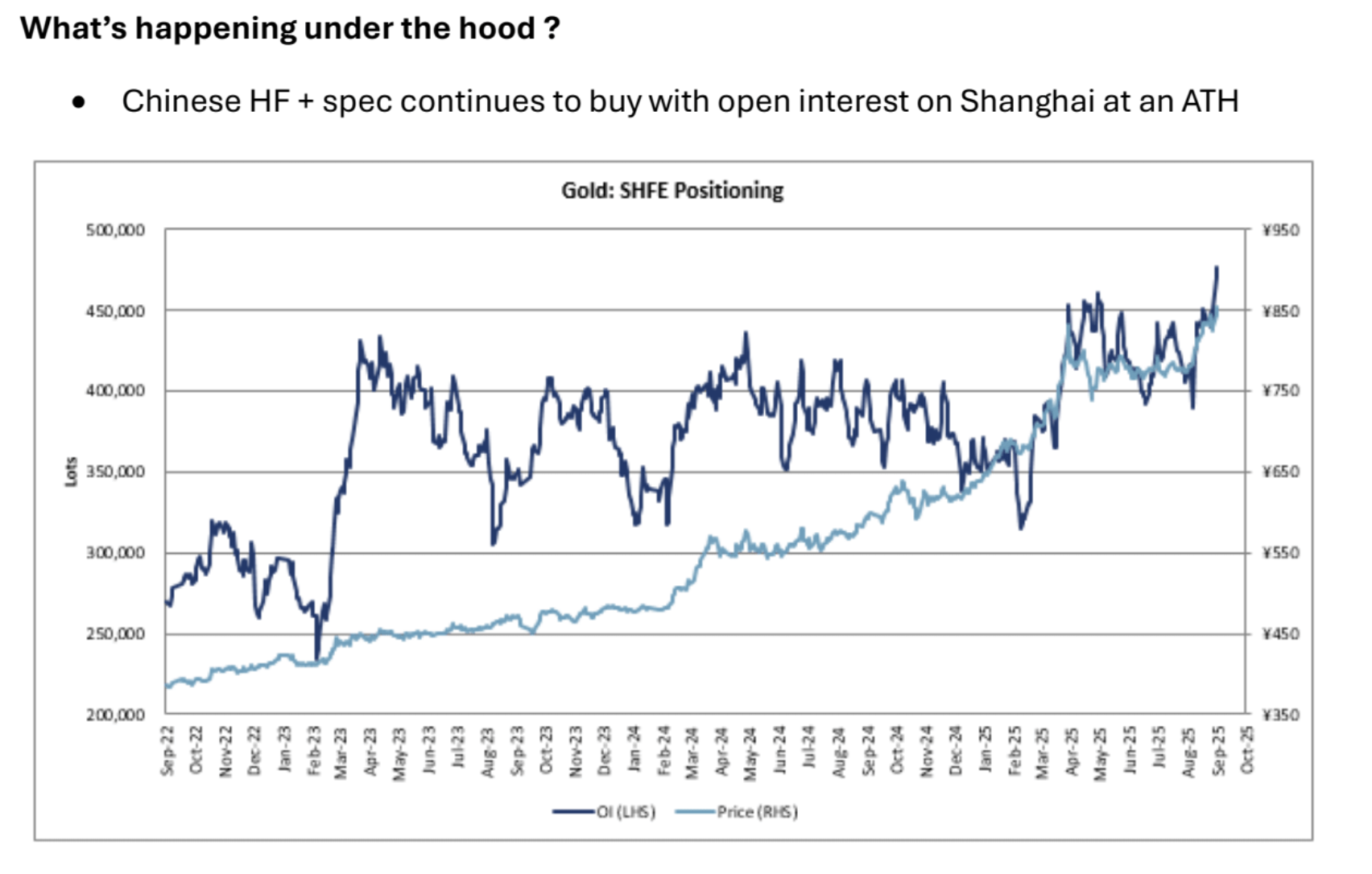

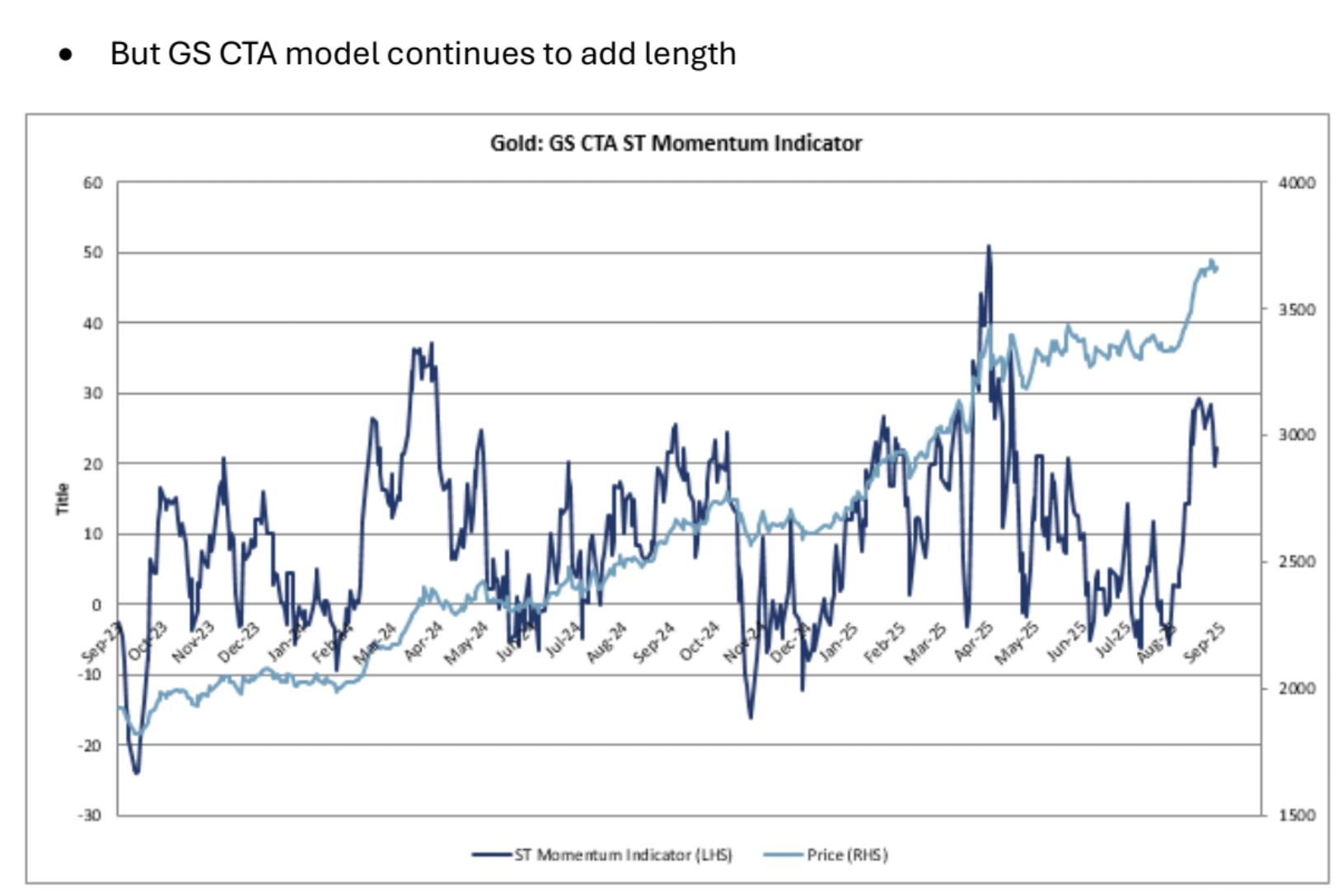

Summary: Chinese speculators increased their positions yesterday but are stable today. ETFs purchased 280k yesterday, compared to 860k on Friday. The volatility move has been fairly stable; 3M ATM increased by +1v with a 25% RR of +0.3v; breakeven is around ~1.25% at 16v. Our trading flow this morning has predominantly been focused on buying volatility through call spreads, though the activity has varied; we've observed RKO unwinds, RKO rolls, vanilla profit-taking, as well as new positions anticipating another ~ $100/oz increase. We haven't observed any interest in strikes above $4,000/oz yet (though this might change when the US markets open). Currently, our quote ratio stands at 90% "macro" versus 10% "commodity fund." Our perspective remains that the pain trade is upward, as the weaker dollar and higher real asset appeal are increasingly drawing non-commodity AUM to gold, while the broader investment community remains underexposed. As one (commodity) client remarked, “Look at how well gold performed last week; it’s not as heavily long as you might believe.” We continue to maintain long positions via 3-6M skew. Additionally, it's noteworthy that China is courting foreign gold reserves in an effort to enhance its global influence: “PBOC is leveraging the Shanghai Gold Exchange to attract central banks from friendly nations to purchase bullion and store it within China.” I have doubts that many DM central banks are actually storing their gold in LBMA vaults, as it somewhat undermines the intent, but the trend is evident; China is aiming to assert greater dominance in global gold trading.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!