Institutional Insights: Mizuho USD 'Messy Correlations, But The Path Is Lower'

USD FX – Complex correlations, but a downward trend likely in the months ahead due to growth dynamics.

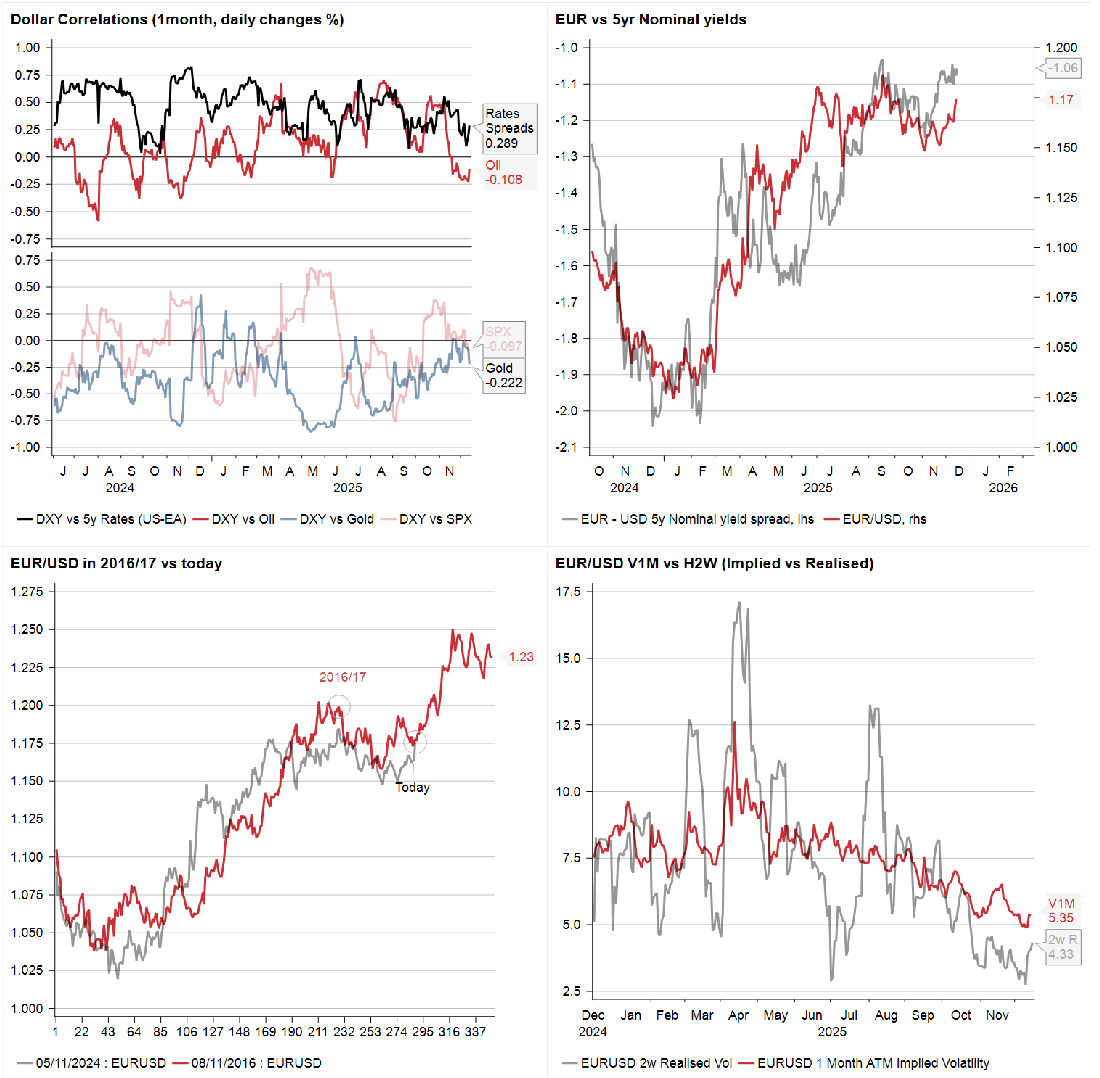

USD frameworks remain challenging: Trading USD in 2023-24 was difficult, but 2025 has proven even more problematic—especially for those relying on macro frameworks. Why? USD correlations with other markets have been persistently inconsistent.

The toughest aspect of FX trading isn’t predicting the direction of rates, equities, or commodities; it’s identifying which factor will drive cross-border flows and ultimately influence currency pairs. This is evident in the reduced relevance of rate spreads for USD, while equities and gold show indecision, and oil prices have shifted to a negative correlation.

A broader perspective suggests it’s unlikely we’ll see a significant USD rally unless US economic exceptionalism resurges. Global growth is being bolstered by fiscal and monetary easing, alongside rising nominal yields in Europe and Japan—a mix that typically hinders USD strength. This scenario could resemble the 2017/18 period, where EUR flirted with the 1.25 level.

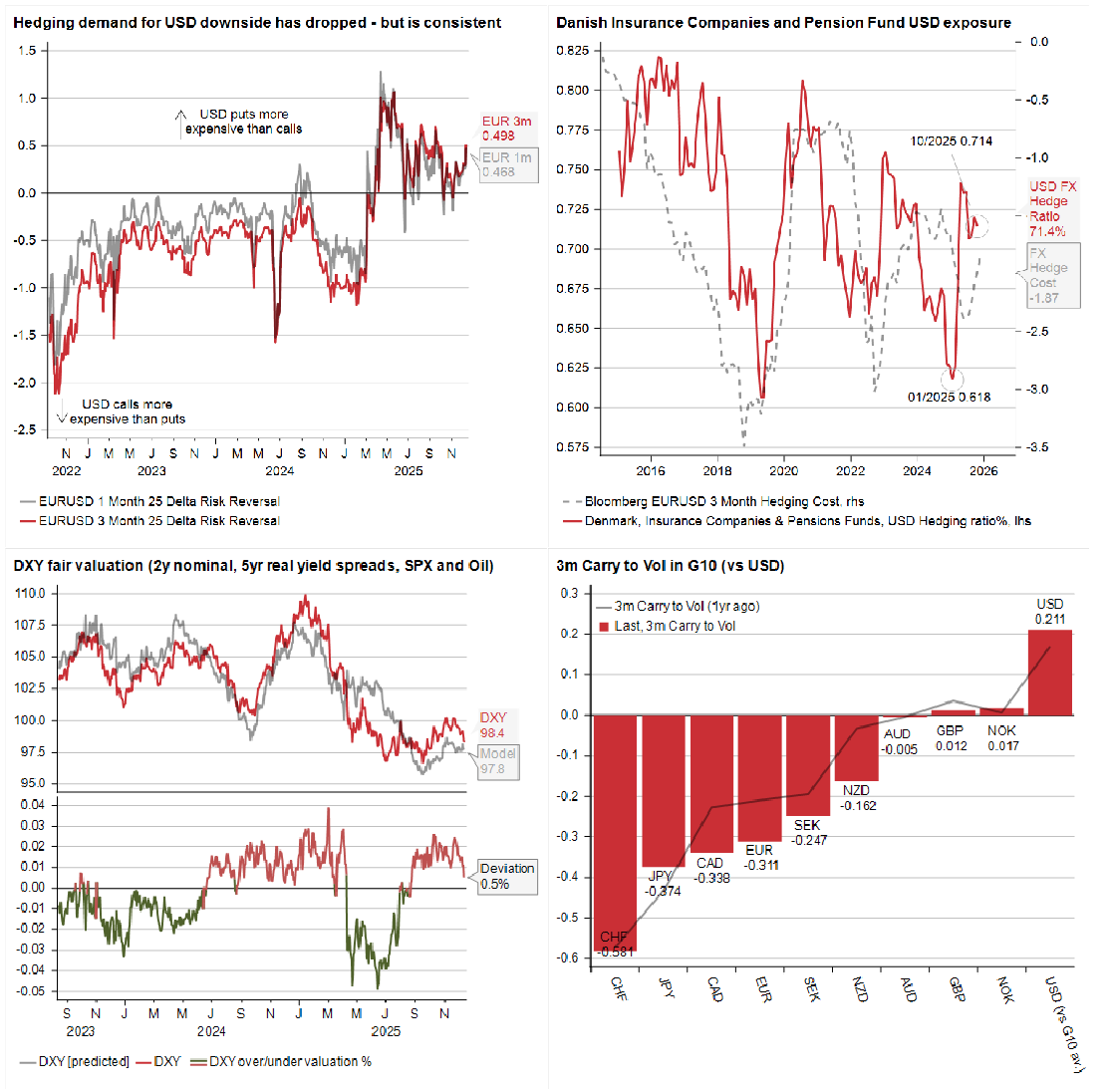

Volatility: FX volatility has been challenging in H2, with 2-week realized vol hovering around 3-4% and 1-month implied volatility at its lows. However, FX skew has surged for EUR upside, driven by hawkish ECB commentary. While the narrative of “USD weakening due to increased FX hedging” for 2026 lacks strong evidence—Danish data indicates pension funds have reduced FX hedges—it’s worth noting falling hedging costs and consistent skew favoring USD puts. These factors contribute to USD headwinds but shouldn’t be the primary driver of directional views for 2026, especially as January often disrupts consensus trades.

Short-term valuation models previously indicated USD was overvalued by about 2%, but the recent selloff has reduced this to 0.5%. It’s important to remember that short USD positions remain a short carry trade in 2026. Calls for rapid EUR/USD depreciation to 1.30 would require significantly stronger inflation data from the Eurozone to shift the narrative and make an ECB rate hike in 2026 plausible.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!