SP500 LDN TRADING UPDATE 6/1/26

SP500 LDN TRADING UPDATE 6/1/26

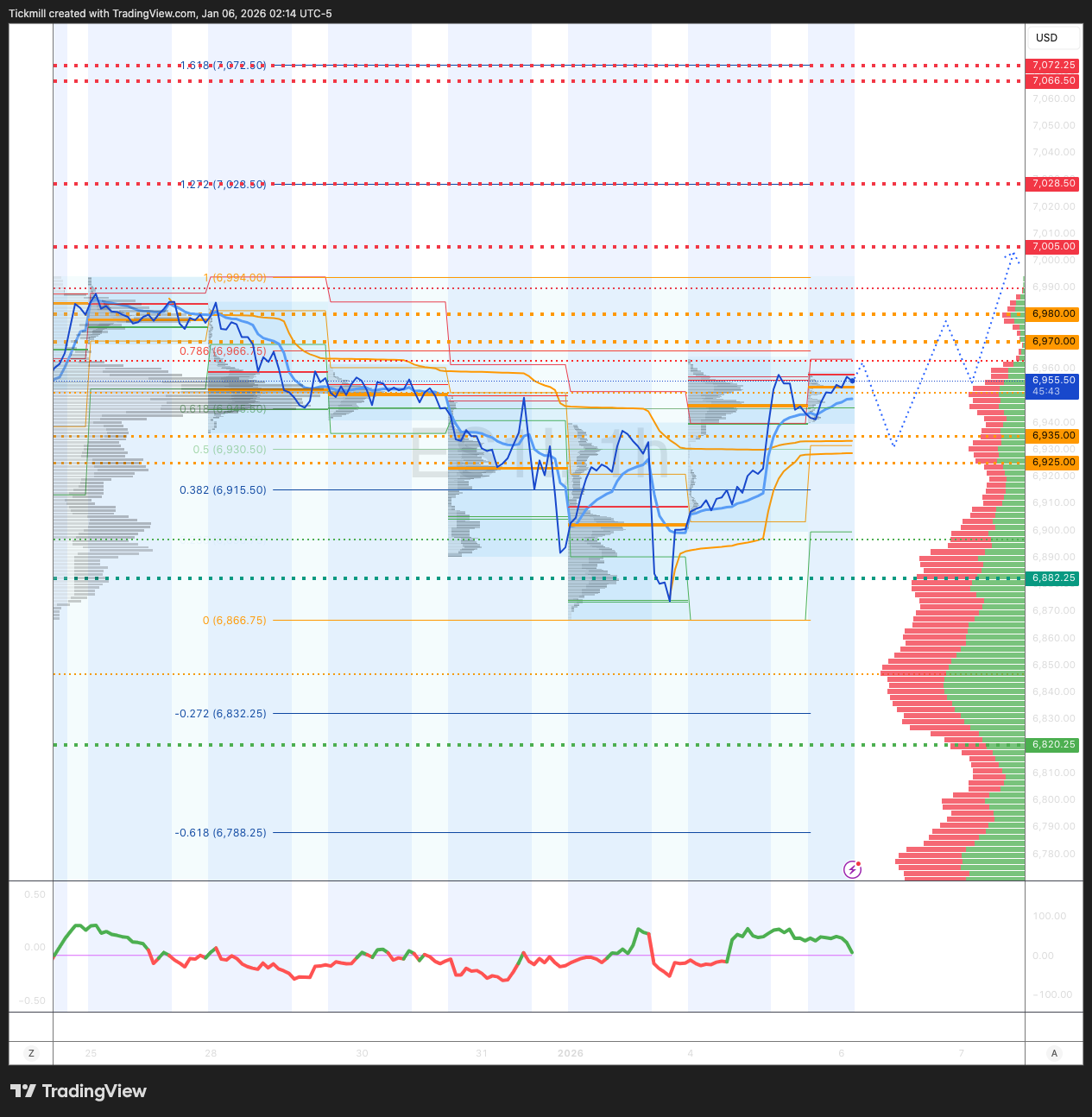

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6970/80

WEEKLY RANGE RES 6984 SUP 6817

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

WEEKLY VWAP BULLISH 6882

MONTHLY VWAP BULLISH 6845

WEEKLY STRUCTURE – BALANCE - 6866/6994

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

The SPX aggregate gamma flip region is around 6870. The upside gamma rises sharply from 6930 and above. Conversely, below 6770, it drops sharply to the downside

DAILY STRUCTURE – BALANCE - 6866/6994

DAILY VWAP BULLISH 6918

DAILY BULL BEAR ZONE 6935/25

DAILY RANGE RES 7005 SUP 6882

2 SIGMA RES 7066 SUP 6820

VIX BULL BEAR ZONE 17.6

PUT/CALL RATIO 1.21

TRADES & TARGETS

LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET WEEKLY BULL BEAR ZONE

SHORT ON REJECT/RECLAIM WEEKLY BULL BEAR ZONE TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW

S&P closed up +64bps at 6,902 with a Market-On-Close (MOC) imbalance of $2.1bn to SELL. NDX gained +77bps to finish at 25,401, R2K surged +159bps to 2,548, and the Dow climbed +123bps to end at 48,977. Total US equity exchanges saw 19.1 billion shares traded, surpassing the year-to-date daily average of 15.75 billion. VIX rose +269bps to 14.9, WTI Crude increased +188bps to $58.39, US 10YR yield dipped -4bps to 4.15%, gold jumped +261bps to 4,445, DXY slipped -14bps to 98.29, and Bitcoin soared +315bps to $94,100.

Markets made a strong comeback with a clear pro-growth, pro-cyclical, and pro-expansionary tone. US cyclicals outperformed defensives (GSPUCYDE) by ~2%, aligning with our house view of a positive US economic outlook for the first half of the year. Our desk observed signs of re-grossing, particularly in retail/discretionary and financials, both of which stand to benefit from anticipated stimulus and deregulation in 1H. Notably, discretionary was the most net-sold subsector on our PB books in December and saw significant de-grossing throughout Q4, with gross allocation hitting 5-year lows.

In tech, the focus remains on the software vs. semiconductors spread, following one of the largest single-day moves in over 20 years last Friday. Feedback indicates that semiconductor strength is more easily explained than the software weakness. In after-hours trading, MCHP rose +7% on updated guidance (again). Keep an eye on analog peers such as TXN, ON, STM, IFX, and ADI.

Elsewhere, hedge funds supplied energy stocks, mainly in services names, following weekend events. Despite this, there hasn’t been any material change in the oil macro environment. Brent positioning remains net short, and our energy conference kicks off this evening, with panels and 1x1 sessions starting tomorrow. US Energy Secretary Chris Wright will be presenting, and we expect insights from companies regarding the Venezuela situation. Broadly speaking, oil supply and demand are expected to remain imbalanced over the next six months. GIR has not adjusted oil price forecasts based on recent events.

Overall trading activity was moderate, rated 6 out of 10. The buy price closed at +235 basis points, while the 30-day moving average was -123 basis points. Asset managers and hedge funds both closed with small net buying, with demand leaning towards pro-cyclical sectors. Market breadth appears to be stabilizing and showing early signs of recovery, but it is not yet strong. Our year-end target price for the S&P 500 is 7600, equivalent to 12% earnings per share growth. There is currently a corporate stock trading restriction period, expected to last until around January 23, 2026. Most corporate inflows are through the 10b5-1 program, which allows purchases during the restriction period. Meanwhile, CTAs have $5 billion worth of U.S. stocks available for purchase this week.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!