US Stocks Plunge on Trade War Risks

Stocks Dumped

Risk assets have come under heavy selling pressure this week as investors continue to move capital away from higher beta positions and into safe-havens. S&P futures have gapped lower today and are down heavily on the session, currently sitting at -2% from yesterday’s highs. The move comes amidst growing uncertainty around Trump’s campaign to secure Greenland. Over the weekend the US President announced fresh 10% tariff set to hit eight European countries from Feb 1st and could rise to 25% by June if they’ don’t co-operate with his agenda. European leaders have responded by drawing up a list of roughly 93 billion euros worth of tariffs to hit the US by Feb 7th if Trump actions those 10% tariffs. As such, global markets are once again on the brink of a trade war and price action is firmly reflecting this uncertainty.

Trump to Speak Tomorrow

Looking ahead this week, the main focus will be on the Davos economic forum with Trump set to speak tomorrow followed by EU leaders on Thursday. Given the risk of further aggressive rhetoric from Trump, risk assets look vulnerable to fresh downside through the end of the week, particularly if EU leaders follow suit and respond in kind on Thursday. The prospect of a fresh trade war runs big risks stocks. As such, only a shift in tone from the EU (open to arranging a deal for the US to buy Greenland) or a walk-back from Trump is likely to revive the near-term outlook for risk assets.

Technical Views

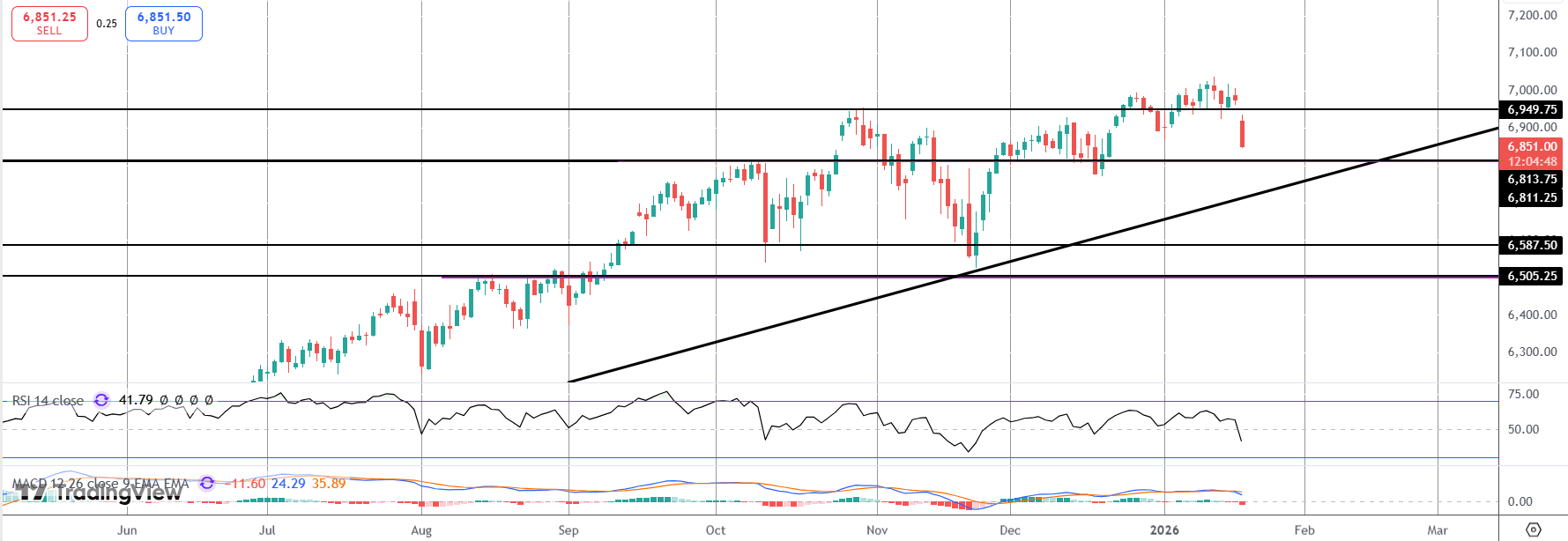

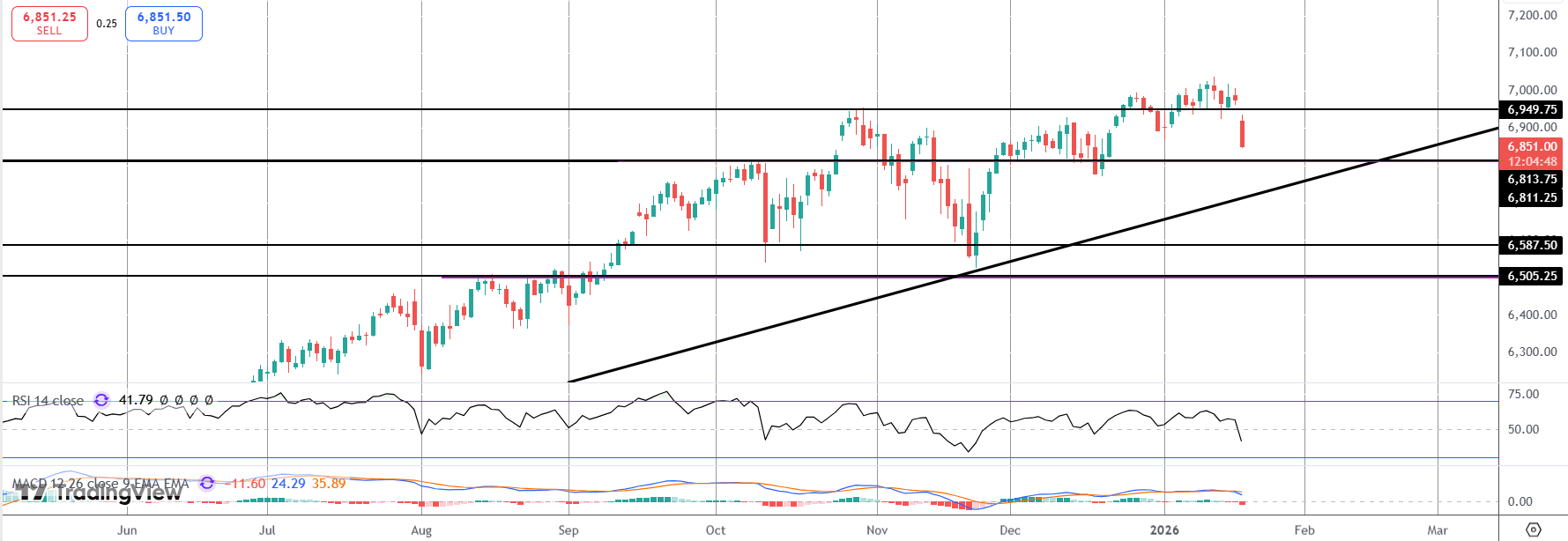

S&P

The sell off has seen price reversing back under the 6,949.75 level and now fast approaching a test of the 6,813.75 level with the bull trend line from 2025 lows coming in just beneath. This is a key support area for bulls to defend or risk a deeper push towards 6,587.50 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.