REAL TIME NEWS

Loading...

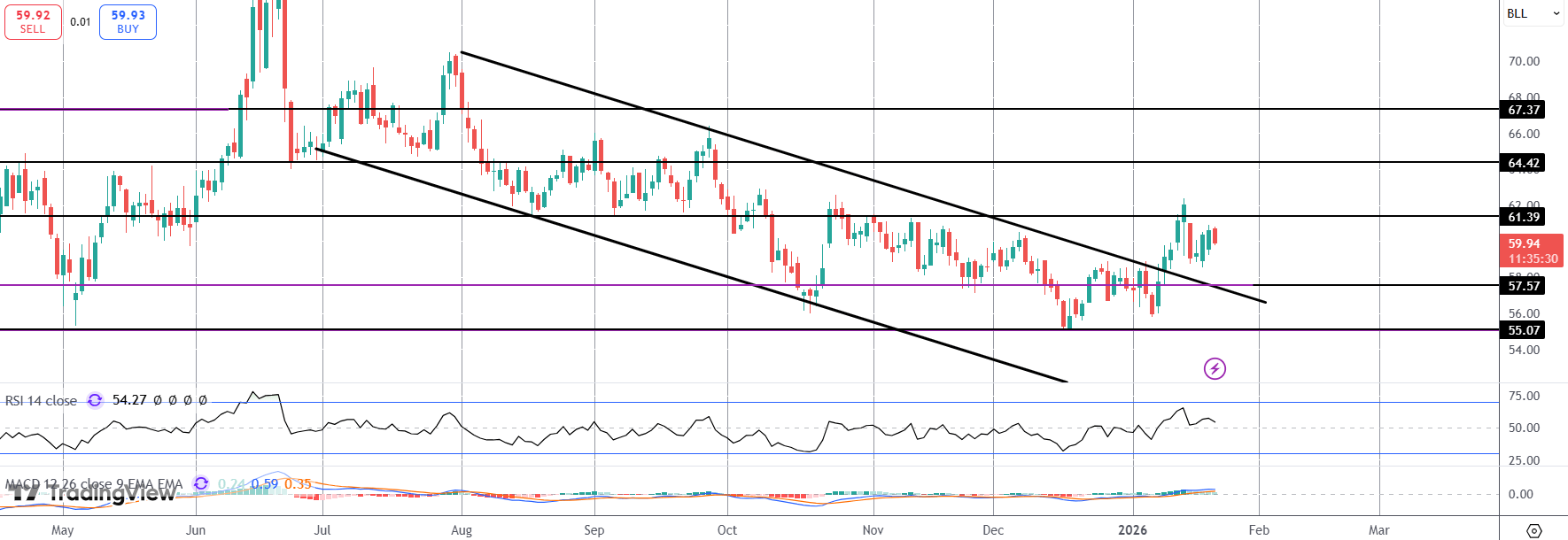

NFP Up NextUS stocks remain weak on Friday with the S&P still down from highs and struggling to stay above the 6,811.25 level. For now, the market remains subject to volatility around incoming Iran headlines. A fresh surge in energy prices as a result of the co...

NFP Up NextUS stocks remain weak on Friday with the S&P still down from highs and struggling to stay above the 6,811.25 level. For now, the market

VWAP Swing Strategy Daily Update 6/3/26Daily VWAP Swing Strategy update reviewing closed & open positionshttps://www.tradingview.com/chart/US500/KDjCrXAj-VWAP-Swing-Strategy-Daily-Update-6-3-26/...

VWAP Swing Strategy Daily Update 6/3/26Daily VWAP Swing Strategy update reviewing closed & open positionshttps://www.tradingview.com/chart/US500/K

Title CHFJPY H1 | Bearish drop off key resistanceType Bearish drop Preference The price has rejected off the pivot at 201.84, an overlap resistance. A reversal at this level could lead the price toward the 1st support at 200.62, a pullback support. Alternative Scen...

Title CHFJPY H1 | Bearish drop off key resistanceType Bearish drop Preference The price has rejected off the pivot at 201.84, an overlap resistance. A

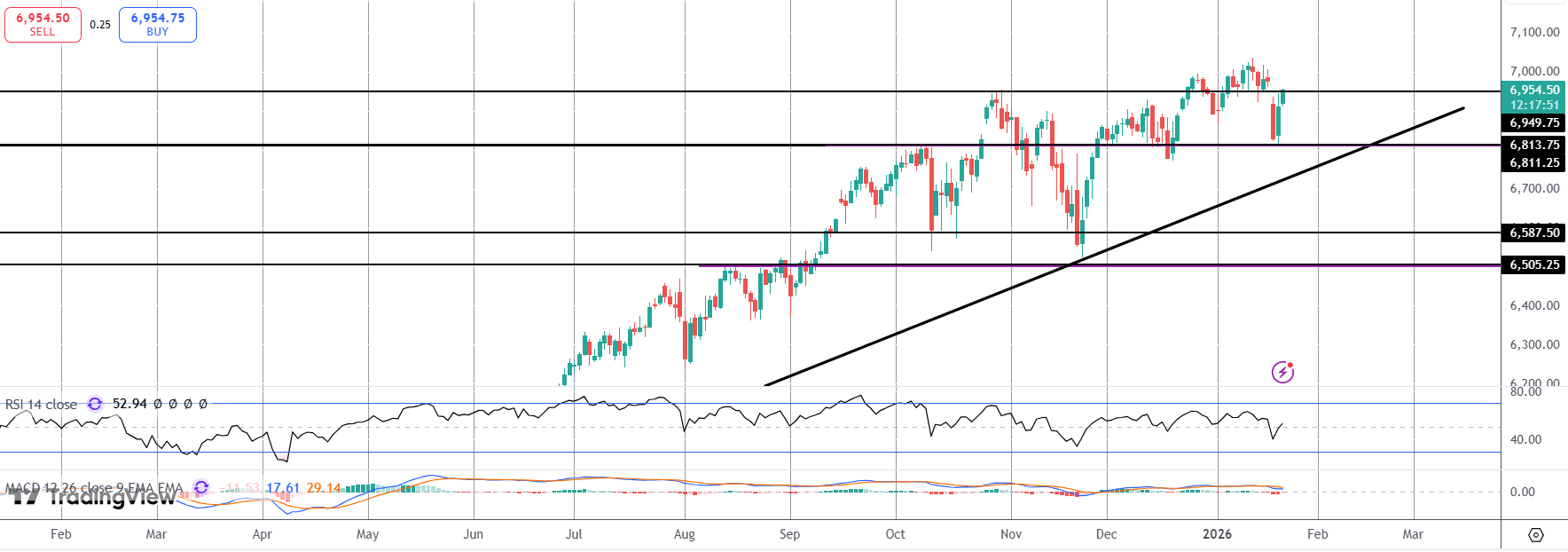

The G10 FX market is in a defensive holding pattern, paralysed by the Iranian conflict and the closure of the Strait of Hormuz. While traditional economic data (US Non-Farm Payrolls) is usually the week's centerpiece, it is currently secondary to geopolitical ...

The G10 FX market is in a defensive holding pattern, paralysed by the Iranian conflict and the closure of the Strait of Hormuz. While traditional econ

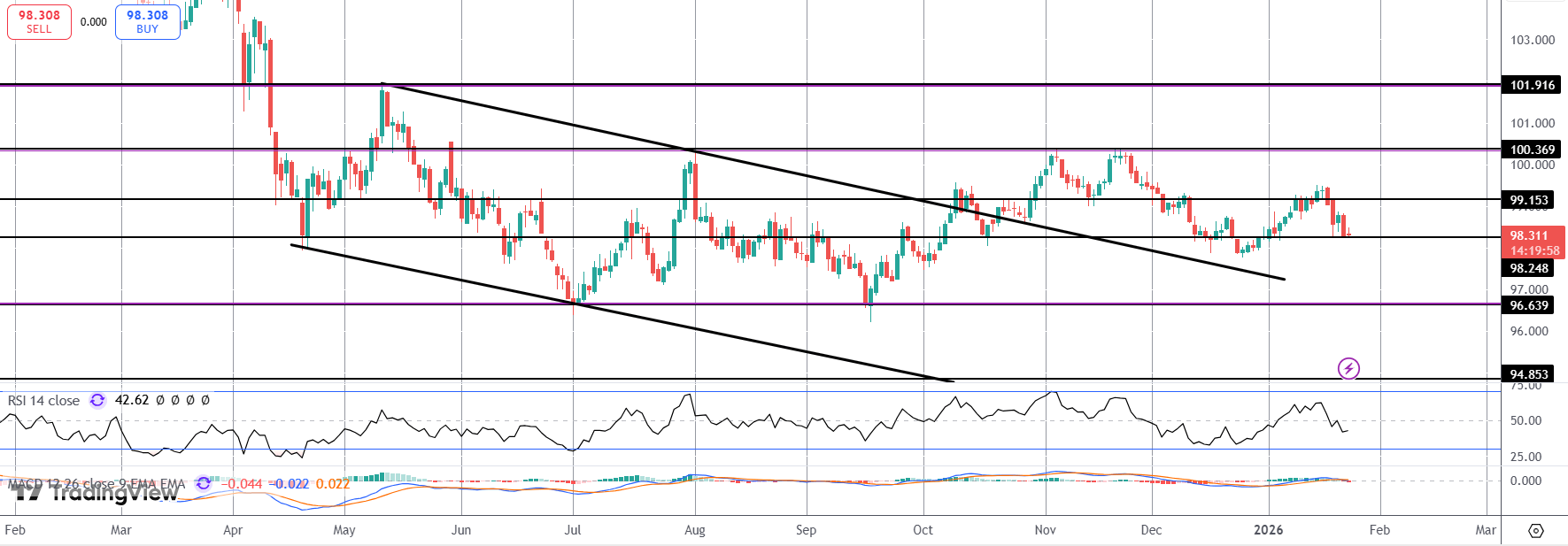

SP500 LDN TRADING UPDATE 6/3/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6940/50WEEKLY RANGE RES 7031 SUP 6745Weekly Straddle Range: 143 -point straddle implies a weekly range of [67...

SP500 LDN TRADING UPDATE 6/3/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR

Nomura sales commentary by Charlie McElligott, detailing the current "de-grossing" cycle and the shifting volatility regime.The Current "VaR Shock" and UnwindThe market is currently experiencing a violent mechanical deleveraging process. After a...

Nomura sales commentary by Charlie McElligott, detailing the current "de-grossing" cycle and the shifting volatility regime.The Current &quo

Daily Market Outlook, March 6, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Global markets managed to find some footing overnight, as several Asian stock indices rebounded from early losses to end in positive territory. Thi...

Daily Market Outlook, March 6, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Global markets managed to find s

Title NZDUSD H4 | Bullish bounce for the Kiwi Type Bullish bounce Preference The price is falling towards the pivot at 0.5848, an overlap support that is slightly above the 61.8% Fibonacci projection. A bounce from this level could lead the price toward the 1st res...

Title NZDUSD H4 | Bullish bounce for the Kiwi Type Bullish bounce Preference The price is falling towards the pivot at 0.5848, an overlap support that

NFP In FocusAll eyes are on the latest US jobs report due later today. Following a stronger ADP number earlier in the week and softer-than-forecast jobless claims yesterday, USD bulls are hopeful for an encouraging number today. Wall Street is forecasting the headl...

NFP In FocusAll eyes are on the latest US jobs report due later today. Following a stronger ADP number earlier in the week and softer-than-forecast jo

Title USDCAD H1 | Could we see a bounce from here? Type Bullish bounce Preference The price is rising towards the pivot at 1.3661, which is a pullback support that aligns with the 50% Fibonacci retracement. A bounce from this level could lead the price toward the 1...

Title USDCAD H1 | Could we see a bounce from here? Type Bullish bounce Preference The price is rising towards the pivot at 1.3661, which is a pullback